- 5 minute read

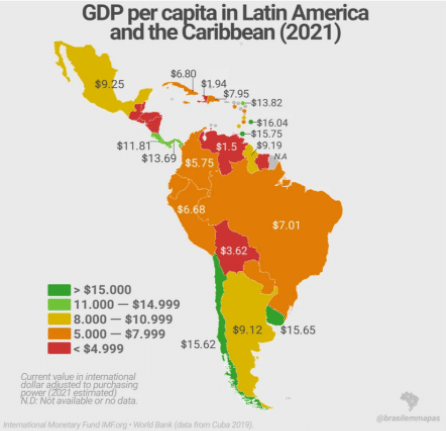

Mexico’s gross domestic product (GDP) expanded by 3.6% from a year earlier in Q4 of 2022, slightly above preliminary estimates. The World Bank expects a 0.9% growth in 2023. Forecasts for the Mexican economy remained unchanged for 2024, with a 2.1% growth prediction. With a population of 130 million, Mexico is Latin America’s second most populated country after Brazil (214 million). Total transaction value in the Digital Payments sector is projected to reach US$90.01bn in 2023. Mexico represents a huge market and a land of great opportunities. Interestingly, even though Brazil is the LATAM leader in terms of the country’s GDP, in Mexico, the standard of living (GDP per capita) is notably higher.

E-Commerce in Mexico is predicted to generate a revenue of over US$42 million in 2023 at a compound annual growth rate (CAGR 2023-2027) of 13.7%. Statista projects its market volume to value US$70,4 million by 2027. Mexicans buy groceries, electronics, furniture, and fashion online. Mercado Libre, Amazon, Walmart, Coppel, and Liverpool are the most popular regional marketplaces. In the first quarter of 2022, Latin American e-commerce giant MercadoLibre saw a 53% rise in the value of its sales. Mexicans also discovered Chinese (Alibaba) and Japanese (Rakuten) marketplaces. To many, it may come as a surprise that Japan is the third-most important destination for Mexican agri-food products.

US, Canada, and Mexico: USMCA replaced NAFTA

On the first of July 2020, the USMCA entered into force. Canada, the United States, and Mexico created the largest free trade region in the world. Its objective was to generate economic growth by removing trade obstacles between the three countries. USMCA prohibits local-storage requirements for data. For example, Mexican regulators must gain access to the data if necessary, and merchants and their payment service providers can store their data in any of the three USMCA countries. This generates less data-center duplication, enhances security, and minimizes data storage costs.

Shipments below $2500 require less paperwork, and shipments up to $117 to and from Mexico are no longer subjected to customs duties.

Mexico, a Chinese Hub for Duty-Free Trade with the US

After the US government imposed special tariffs on China in 2018, Chinese companies moved their businesses to Mexico, where the minimum wage a day equals USA minimum wage an hour. Since then, Chinese companies have invested massively in Mexico, establishing factories in Border States that allow them to label their goods “Made in Mexico” before being transported to the USA and duty-free. The Mexican border state of Nuevo Leon has become a Chinese trade hub with the USA. By 2021, Chinese companies accounted for one-third of foreign investment in Nuevo Leon, second only to the USA (47%).

Cross-Border Commerce

Expanding business relationships between China and Mexico are also reflected in cross-border e-commerce trends. In 2017, Mexico’s government signed a deal with Alibaba Group Holding Ltd to get Mexican products on Chinese e-commerce platforms. The Chinese e-commerce powerhouse invested in the creation of ‘digital communities’ in each of Mexico’s 32 states. Alibaba shared logistics and payment capabilities to help Mexican enterprises sell in China. Soon, Chinese tourists discovered Mexico and the sweet taste of its avocados, tequila, and hot jalapeno peppers. Part of the deal was that Mexicans gained more accessible access to Chinese online marketplaces while offering Mexican businesses to sell via Alibaba. Mexican e-shoppers were used to buying on USA and Japanese marketplaces but soon discovered Alibaba’s sharp prices. However, most of Mexico’s cross-border e-commerce still involves commerce between Mexico and the neighboring US.

Mexico: Digital Payment Trends

Card payments are the country’s preferred method for online purchases, followed by digital wallets and mobile e-transfers. According to FIS Worldpay preferred payment methods in Mexico are by credit card (35%), e-Wallets (27%), debit card (19%), bank transfers (8%), postpaid (6%), cash on delivery (3%), and other (1%). Digital Wallets are becoming extremely popular.

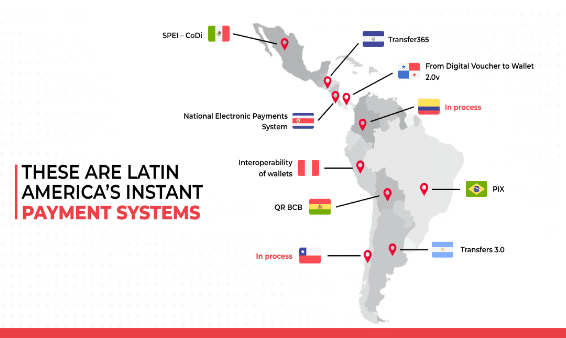

Mexico’s secure, instant payment method is called CoDi, a 24-hour instant funds transfer platform created by Banco de México. CoDi resembles Brazil’s PIX but is not half as popular (yet). It works with QR Codes and is very cost-effective for merchants who are saved from chargebacks and high transaction fees.

SPEI is CoDi’s competitor, a free instant bank transfer payment method with real-time confirmation. SPEI requires a bank account, and Mexico still has a large unbanked population. Nonetheless, its use has doubled, and SPEI and CoDi are expected to gain in popularity as 84% of the population will have access to mobile internet by 2025, compared to 64% in 2020, especially now that the Mexican government is boosting both fiber and mobile broadband throughout the country.

For more information about Mexico’s payment methods, kindly refer to our previous blog about Merchant Business Opportunities in Latin America.

Challenges: Declined Transactions

One of the biggest challenges for merchants that operate in Mexico is the country’s high bounce rate. Only 62% of online card transactions were approved, according to Condusef. Merchants must partner with a payment processor with a solid risk management system that detects and prevents fraud. A counter-fraud system empowered by Machine Learning and Artificial Intelligence. A system that prevents chargebacks and minimizes declined transactions due to false positives. A payment facilitator that offers bilingual customer service and safe cross-border payment processing in compliance with international legislation to save merchants from the risk of non-compliance.

Rules apply to businesses engaged in social media and video streaming services or other age-restricted companies such as e-gaming and e-gambling. Suppose Mexican merchants want to operate in the USA or vice versa. In that case, it is crucial to partner with a reliable and experienced PSP that knows US and Mexican rules and regulations concerning AML, Customer Identification (KYC), and recently implemented Age Verification laws.

For more information about these specific topics, please refer to our recent blogs that explore Online Gaming, Esports, and the power of Biometrics to optimize Age Verification.

Want to learn more about Digital Payments?

********

This article was written by SandeCopywriter on behalf of Segpay Europe