- 5 minute read

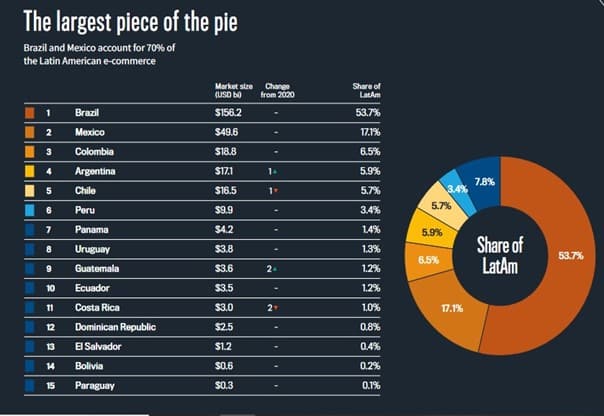

Latin America (LATAM) is a very exciting market for merchants that want to expand their services cross-border. Home to 656 million people and 260 million online shoppers, Latin America is the region with one of the fastest-growing e-commerce markets in the world. In Latin America, e-commerce is expected to reach a $379 billion value by the end of 2022 at a 32% CAGR.

Smartphone penetration has become a major driver of e-commerce in this region. In 2020, m-commerce surpassed online purchases, made on desktops. According to new data from EBANX and AMI (Americas Market Intelligence), almost 60% of LATAM’s e-commerce total volume was paid through smartphones. For merchants with cross-border ambitions, LATAM is an exciting market, where e-commerce is expected to grow by 30% each year. Merchants that want to reach out to Latin American shoppers will have to offer their customers mobile payment solutions. Let’s have a look at how Latin American e-shoppers prefer to pay for their online purchases.

LATAM: Preferred Payment Methods

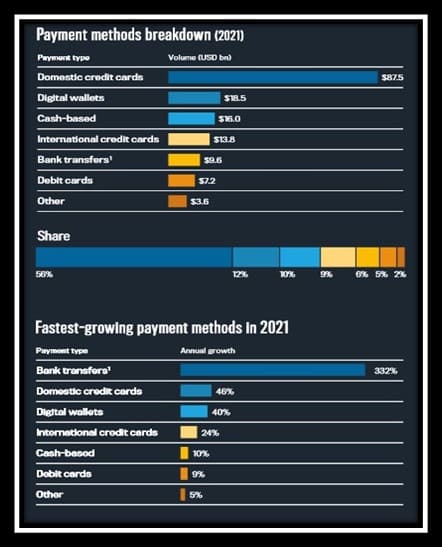

Before expanding into the Latin American e-commerce market, it is important to understand the regional payments landscape. Although credit cards remain the region’s preferred online payment method – 39.3% of last year’s transaction value – digital wallets were used in 19.2% of online purchases. Mexico leads the way with a quarter of online purchases paid through e-Wallets. Latin American e-shoppers use PayPal, Apple Pay, Google Pay and they can choose from a growing amount of regional wallets like NuBank, Mercado Pago, PicPay, PagSeguro and RappiPay.

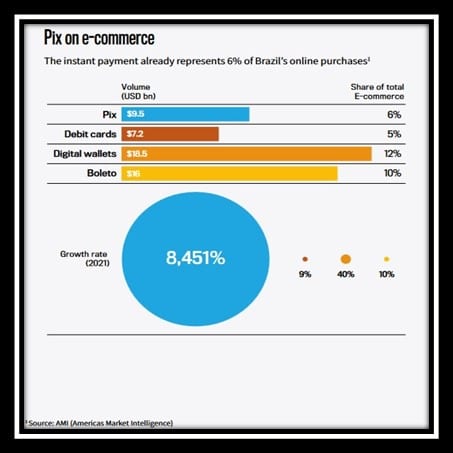

One tenth of online purchases are currently paid with bank transfers, but this figure is bound to rise, once the PIX revolution expands from Brazil to the rest of Latin America.

Introduced by the Central Bank of Brazil in 2020, Pix facilitates P2P, P2B and B2B real-time payments. A fascinating phenomenon that has pushed financial inclusion and which we will explore further in the Brazilian chapter below. Besides bank transfers, wallets and card payments, Latin America is following global trends such as the use of QR codes, BNPL, plus Brazil and Mexico have added NFC-initiated payment capability backed up by real-time payments.

Where do Latin American shop and purchase online? The five largest e-Commerce Marketplaces in Brazil, Mexico and Colombia are MercadoLivre/Mercado Libre, OLX, Americanas, Coppel and Amazon. Walmart is also trying to enter in the Top 10, but it is hard to compete with Latin America’s market leaders such as Mercado Libre which has a strong presence all over the region.

Source: EBANX

Brazil, Latin America’s Emerging Giant

Latin America’s largest economy and 8th economy worldwide, Brazil has a population of more than 215 million people. Brazil stars 4th on the list of fastest growing e-commerce economies. Brazil counts 128 million e-shoppers in an e-commerce market worth $156 billion (2021). Forbes ranked Brazil as having the 7th largest number of billionaires in the world.

Source: AMI

How do Brazilians pay online? Brazilians pay with VISA and MasterCard, Boleto Bancario, digital wallets and with bank transfers (Pix). Pix is one of the most popular and fast-growing payment methods in Brazil. Built and owned by the Central Bank, Pix works with a Dynamic QR code or with Code Copy, depending on the user’s device. Launched in November 2020, in the middle of a pandemic, the Brazilian Central Bank estimates that over half of adult Brazilians have used Pix. A curious phenomenon is called “Pix Tinder”. Five months after Pix was launched, 1 million very small transfers were made to flirt with other Pix users, because the app includes a message field.

Although Boleto is still leading, Pix is a very strong rival, because its user-friendliness. Even though it started off as a P2P method, merchants quickly started to offer Pix to their customers for P2B payments. Shoppers simply select Pix at the checkout page and scan a QR Code using their smartphones or copy and paste a Pix code into their banking or digital wallet apps.

AMI research estimates that P2B payments with PIX will double each year, until 2024 when Pix P2B transactions are expected to reach $70 Billion in 2021, which is equivalent to 10% of the real-time payment’s total volume.

Brazil’s Central Bank is actively promoting its use, mandating that all financial institutions that have over half a million customers include Pix to its payment options. Pix will largely replace the existing SITRAF transaction mechanism.

The Pix revolution doesn’t stop here; Pix is planning to develop Pix Saque, Pix Troco (both for withdrawals) and Pix Garantido (for installment payments). Open Banking began in October 2021 and will be implemented throughout 2022 in these different phases that Brazil’s central bank has outlined. During phase 3, customers will be able to check out online using Pix, without having to be redirected to their banking app.

A third of Brazil’s population is unbanked, which explains why Boleto Bancário and Pix are so popular. While Pix payments are made with mobile phones and QR Codes, Boleto works with vouchers with a barcode that can be taken to a bank, ATM, or payment processor. This payment method is regulated by the Brazilian Federation of Banks and is free of chargebacks.

Regional e-wallets like MercadoPago or PagSeguro, PicPay, ITI are also popular in Brazil. With 65 million registered users, PicPay is Brazil’s leading e-Wallet. Headquartered in Brazil, NuBank is the most widely used e-Wallet in Latin America with 59.6 million users in Brazil, Mexico and Colombia. MercadoPago Wallet is used by 36 Million Latin Americans and PagBank/PagSeguro’s Wallet is used by 23.5 million LatAm users.

Latin American brands like Hipercard and Elo, BitPay, PaySera, PayU, (PayPal) Hyper Wallet and Skrill are used across Latin America.

Source: EBANX

Mexico; Where e-Wallets are Hot

Mexico is the second most populous country in Latin America, with more than 127.8 million inhabitants of whom half have internet access. 64 million Mexicans shop online in an e-commerce market valued $49.6 billion in 2021.

With regards to Mexicans’ preferred payment methods, FIS Worldpay gives us the following figures: Credit card (35%), e-Wallets (27%), Debit card (19%) Bank transfers (8%), Postpaid (6%), Cash on delivery (3%), Other (1%). A remarkably high use of digital wallets.

Source: IUPANA

According to Mexican Business News, Mexico counts 5 million active PayPal users. Mercado Pago functions similarly to PayPal, where users create an account and link out to a bank account or credit card to fund purchases. When shoppers make a purchase, they select Mercado Pago as their payment method, after which they are redirected to a payment page. Mexicans also use credit (34.6%) and debit (19.3%) cards. Carnet is Mexico’s local card payment brand that allows Mexican banks to issue cards and acquire carnet transactions from connected merchants. Banamex issues debit and credit cards to Mexican consumers and businesses and issues under MasterCard and Visa licenses. Most merchants accepting MasterCard and Visa will be able to process Banamex credit and debit cards.

Led by PayPal, BBVA Wallet and Mercado Pago, digital wallets accounted for 26.9% in 2021. The Banco de México recently launched mobile payments through CoDi, which enables P2P, P2B, B2B and B2P payments. BNPL companies are eager to reach out to hundreds of millions of debit card holders in Brazil and Mexico who do not have access to credit cards.

Source: AMI Analysis

This graphic shows the great potential of Buy-Now-Pay-Later (BNPL) payments in the largest e-commerce markets of LATAM, Mexico, and Brazil. TPV stands for Total Payment Volume, expressed in billions of dollars. In 2020, the Mexican Central Bank published its first open banking rules. The next phase is the transactional data phase, but these isn’t a definite timeline for its implementation yet. Once Open Banking is implemented, Mexicans will get access to a wide range of alternative payment options.

Colombia; Blockchain-based Instant Payments Pioneer

Colombia has 21 million online shoppers in an e-commerce market worth $18.8 billion in 2021. The e-commerce market in Colombia is expected to grow by 26% in 2022 to reach a volume of US$28.3 billion. E-commerce in Colombia is expected to grow to $56.8 billion by the end of 2025. Colombia has an extremely high banking penetration rate: 90% of the adult population has a bank account. However, most cardholders own debit cards. Still, 35% of all e-commerce purchases are made with credit cards.

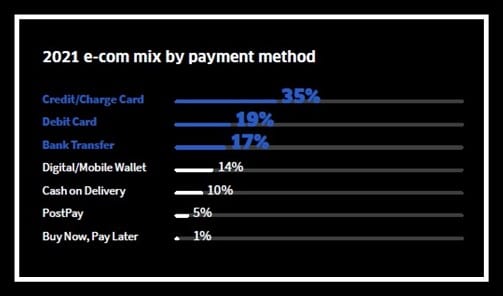

Source: FIS Worldpay

17% of all purchases are made through bank transfers. Digital and Mobile Wallets are becoming increasingly popular. Other payment methods are BitPay, PayPal HyperWallet, PayU, PaySera and Skrill. Real-time payment services are made available thanks to Open Banking APIs. Developed by Bogota-based fintech Minka and ACH Colombia, Transfiya is a blockchain-based instant payment solution, developed by seven banks, two mobile wallet providers, a financial cooperative and fintech Sedpe. Transfiya reduces the cost of bank transfers from $2-$5 USD per transaction down to zero.

In Colombia, real-time transfers made via PSE (Pagos Seguros en Línea) are growing in popularity, since the Colombian government offers tax incentives to companies that offer this payment methods to its customers. This instant payment was developed by Colombia’s national clearinghouse (ACH) for secure online transactions. AMI expects that PSE will ultimately be used for over a quarter of all Colombian e-commerce transactions.

The Latin American streaming market is the second fastest growing in the world

Last but not least, according to a study provided by data research company Netscribes, the Latin American audio and video streaming market is the 2nd fastest growing in the world. This makes Latin America an interesting market for a Payment Service Provider, specialized in offering safe and reliable subscription payment solutions. Segpay is such a PSP. Merchants that are interested in doing business in this exciting region, but hesitate because of a lack in understanding how to proceed in the safest, timely and cost-efficient manner, can contact Segpay for more detailed information.

Want to learn more about LATAM payment options?

Contact us today, we’d love to chat with you about accepting payments in this region. It’s another way we are here for our merchants All the Way to Paid ™. Reach out to us with your questions at [email protected].

Author @SandeCopywriter on behalf of Segpay Europe.