Reaping the Benefits of PSD2 and API Technology

- 5 minute read

The EU’s 2nd Payment Service Directive (PSD2) has become the main driver for Open Banking. What is Open Banking? Open Banking gives Third-Party Providers (TPPs) access to payment transaction data through Application Programming Interface (API) technology. Programmers do not need to know how an API is implemented; they simply use the interface to communicate with other products and services. In this case, data is shared via secure networks between financial institutions (I.e., Banks, Merchant Acquirers, PSPs). Open Banking and APIs have created exciting business opportunities for Fintechs, established e-commerce companies and innovative start-ups to build new custom services around payments; alternatives that are disrupting the banking industry and have forced legacy banks to step up their game and innovate their value proposition.

Open Banking is changing the way people use banking services and this is only the beginning. Over the past years, PSD2 has boosted competition and payment innovation as it reshaped the EU payments sector. Legislators in the different regions see this as an interesting testcase which is about to transform the payment industry worldwide. Open Banking has created an exciting landscape for the rise of new payment methods that offer millions of banked and unbanked customers’ user-friendly alternatives to shop and pay online and to send money cross-border without having to pay high commission to money exchange providers. It also simplifies payments for international investors, traders, and transactions around supply chains. PSD2 is currently under review. An in-depth assessment of its consequences and ways in which PSD2 could be improved will help to draft EU’s coming Third Payment Directive (PSD3).

PSD2 and Open Banking has improved issues around pricing transparency, security, reporting and innovative technology. Customers benefit from secure and intuitive banking and payment apps. Open banking reduces the number of players in the payment chain, which is more cost-efficient for merchants.

Smooth Cross-Border Payments

Edgar, Dunn & Company’s “Future Fintech – No Borders, Just Horizons – How digital is shaking up international trade, markets, and finance” report estimated that by 2027, a remarkable $2.7 trillion (14% CAGR) will be spent on global cross-border e-commerce, more than a quarter of all e-commerce sales worldwide. The report forecasts that Asia-Pacific will represent 51% of global ecommerce in 2027 followed by North America at 26% and Europe at 18% with alternative payment methods becoming mainstream.

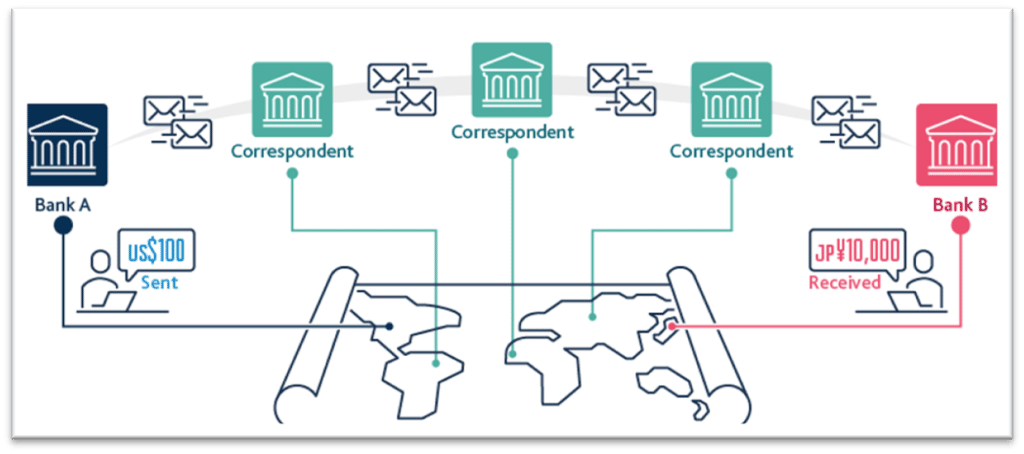

Before Open Banking, merchants that wanted to expand their geographical footprint by selling cross-border fully depended on intermediaries that allowed them to accept local and card payments from abroad. US merchants had to study local rules and regulations and comply with local data and privacy laws or partner with an international processor. Each bank in the payment chain charges fees and exchange rates (figure below).

Cross-Border Payment Process

Source: Bank of England

APIs can be designed to accelerate a secure and cost-efficient cross-border payment process. Open banking gives merchants access to cross-border payment transactions without having to worry about the many local and regional differences in legal requirements and local payment cultures. Issues around long transaction chains, high set-up, and exchange fees and dependence on legacy technology are solved and make payment faster and cheaper for all stakeholders in the value chain.

Payment service providers and merchant acquirers are pushed to innovate and invest in value-added-services in an increasingly competitive payment landscape. PSD2 has proven to innovate payments in the EU and abroad. In the UK, the amount of open banking users has tripled since 2020. According to the Bank of England, cross-border payments are expected to grow from $150 trillion in 2017 to an estimated $250 billion by 2027.

Open Banking as a PSP’s Value-added-Service

If Open Banking replaces and reduces the number of intermediaries that facilitate cross-border transactions, where do the PSPs fit in? PSPs can benefit from open banking by offering merchants yet another VAS; accept payments from customers via instant A2A bank transfer. PSPs can offer open banking as a plugin for mobile apps, platforms and marketplaces. The demand for strong customer authentication (SCA) for all online transactions above €50 in Europe isn’t an obstacle, because A2A payments have multi-authentication factors built in. With bank transfers, customer identification procedures do not have to rely on third parties, because the banks already verified and assessed the customer during customer acceptance. Leaving out the third-party KYC services saves payment service providers costs.

Open banking and API connectivity are driving Bank Account-to-Account (A2A) payments. IDEAL in The Netherlands, SOFORT in Germany and BLIK in Poland have proven that A2A payment options present digital shoppers with powerful alternatives to card payment methods. Consumers like to pay from their banking app, an interface that they are familiar with. A2A payments also present millions of online shoppers who do have a bank account but don’t have access to credit cards with a great alternative payment method. E-commerce purchases are simply authorized from within the interface of the shopper’s bank app. This is a secure, user-friendly and time-efficient alternative to card payments, especially in a digital age where a growing number of consumers use their smartphones to manage their bank account and surf, shop and pay online.

Open Banking and the Subscription Payments Model

The rise of the subscription economy exposed the fundamental problems with these payment mechanisms. For those merchants who rely on subscription payments, API technology can also facilitate Variable Recurring Payment (VRP) capabilities. How? By replacing ‘card on file’ with an ‘account on file’ function. The British Open Banking Implementation Entity (OBIE) creates software standards and industry guidelines, while The Competition and Markets Authority (CMA) mandated nine UK banks (the CMA9) to implement a VRP open banking API. VRPs that are designed to operate within customer-defined parameters where the amount to be taken over a given time period and the end date of the permission is agreed upfront. According to the OBIE: “VRPs are quick to set up, and the exact value of the payment can be changed dynamically (within the payment parameters), right up to the point of irrevocable payment, so customers can respond to changes in real time.”

In conclusion, this is just the beginning and soon we will see more ways in which Open Banking and API technology will provide solutions for the complex issues that have challenged the global payments industry over the past decade.

If this article has made you curious about how Segpay could solve your payment issues, feel free to contact us.

Contact us today, we’d love to chat with you about your payment issues. It’s another way we are here for our merchants All the Way to Paid ™. Reach out to us with your questions at [email protected].

Author: @SandeCopywriter on behalf of Segpay International