- 10 minute read

Online gaming is hot! In 2021, an estimated 3 billion gamers worldwide generated $180.3 billion in revenues, with investments hitting a new record of $150 billion in M&A and IPOs. When Microsoft offered nearly $70 billion for Activision Blizzard at the beginning of 2022, it became obvious that “the game is on.”

Gamers used to buy boxed games, mostly in record and cd shops. Today, the online gaming industry uses different business models:

- Subscription-based Gaming

- Download-to-Own

- Pay-to-Play

- Play-to-Earn

This article explores Latin America’s growing eGaming and iGaming markets. E-Gaming refers to online gaming, while iGaming refers to online gambling. This region is so interesting for the online gaming industry because there are very few language barriers. With a few exceptions in the Caribbean and on the mainland (I.e., Brazil, Surinam, and British and French Guyana), the vast majority of Latin America speaks Spanish. Competitive online gaming involves a lot of communication between teammates and opponents. Gamers from all over the continent find each other, united by one language.

With over 216 million inhabitants, Brazil is Latin America’s largest gaming market, followed by Mexico and Colombia. The Brazilian government announced a tax reduction on video game consoles, accessories, and games. This initiative boosted sales in an emerging gaming industry. Since then, many new video games have been developed for the Brazilian local market, such as Warzone Brazil, GTA Brazil, Assassin’s creed Brazil, and Cyberpunk 2077 Brazil.

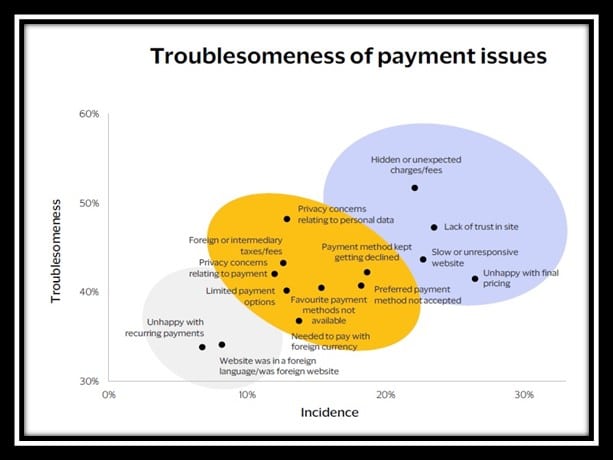

Regardless of business model or geographical region, paying gamers need a smooth, seamless, and frictionless payment experience in their preferred payment method. In largely unbanked regions, players also need to be able to pay cash-based, through prepaid gift cards, instant mobile payment methods, etc.

According to leading Gaming market research agency Newzoo, gamers have paying issues caused by privacy concerns, fear of hidden or unexpected charges, or their preferred payment methods being unavailable.

Latin America’s Paying Gamers

Statista predicts that the growth of online gross gaming revenue in Latin America will grow significantly during the next years. Statista estimates that total gaming revenue in Brazil will amount to $1.3 billion by the end of this year, followed by Mexico ($1.2 billion), Chile ($354 million), and Colombia ($303 million).

Keep in mind that not all these players play online or pay for added features. Latin America and the Caribbean are home to 146 million paying gamers in need of frictionless payments, the majority of whom live in Brazil, Mexico, and Colombia.

Paying gamers spend money to unlock extra content, added skills, tools, “power” or to personalize their avatar character. Newzoo’s latest Latin American data suggests that 43% of the region’s players exchange in-game currencies. One third is discouraged from paying, because they fear unexpected fees or because their preferred payment method is not available.

Latin American gamers prefer to pay with credit cards, debit cards, prepaid/gift cards that are sold in shops or with digital wallets (I.e., Google Pay, etc.). Conversion rates will be boosted by offering gamers local, regional, and instant payment methods such as PagSeguro, PicPay, and Pix. For those readers who are interested in the region’s preferred payment methods, we refer to Segpay’s long-read about Merchant Business Opportunities in Latin America.

Mobile Gaming in Latin America

Driven by the 2020 pandemic, when hundreds of millions of people were under lockdown, internet penetration has increased worldwide and LATAM is no exception. This has boosted e-commerce, online payments, and online gaming.

With around 533.17 million internet users, Latin America & the Caribbean together represent the fourth largest regional online market, behind Asia, Europe, and Africa.

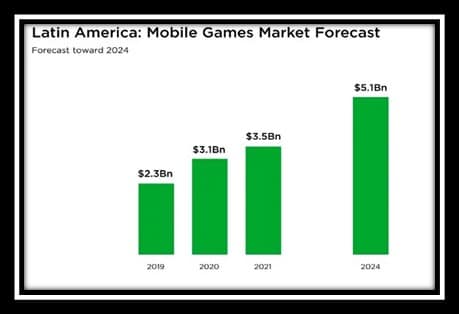

Mobile gaming is hot in a region with hundreds of millions of mobile internet users. Over 273 million people across Latin America and the Caribbean play games on their mobiles, which is more than all gaming players in the United States (212 million). The Latin American mobile gaming market generated $3.5 billion in consumer spending revenues in 2021, revenue that will grow to over $5 billion in 2024. Almost half of the region’s gaming revenue will be generated by mobile gaming. Garena Free Fire, Arena of Valor, and Mobile Legends: Bang Bang are popular in this region. Latin America’s esports gaming generated around $47.5M million last year, at a +16% YoY growth rate.

Most of the region will have access to 5G over the next five years. 5G will drive sales of fidelity mobile games, improve multiplayer gaming experience, and optimize the competitiveness of mobile e-Sports. Latin America’s mobile gamers mostly play strategy games, shooter games and racing.

Cloud-Based Gaming Services

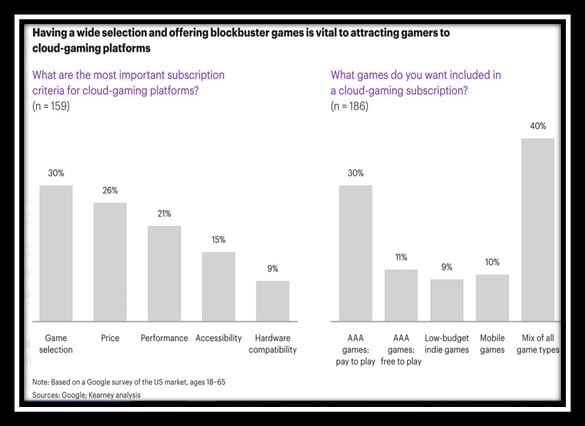

One of the emerging trends in online Gaming is the possibility to game in-the-Cloud. Games become accessible to players who wouldn’t be able to play due to OS, hardware, or device limitations. Thanks to cloud-based gaming, these gamers no longer have to own expensive computers, heavy laptops, or the latest operating system. The Cloud offers them the best graphics and intelligence and seamless access to multiple games. Business models are rapidly changing from product-based to service-based, which requires partnership with Payment Service Providers. PSPs that are specialized in offering secure, subscription-based payment services.

The sales of cloud-based gaming will be accelerated by innovative technology. Service-based business models will depend on who offers the best value-added-services. This is true for the cloud-gaming business as it is for payment facilitators that service this vertical market. Cloud-based gaming will boost hardware sales that allow gamers to enter a virtual reality through innovative VR gadgets, headphones, etc. The main driver for cloud gaming is the fact that gamers get access to a great variety of games through one single subscription.

Examples of this trend are Microsoft’s launch of Xbox Cloud Gaming in Brazil and Mexico last October and GeForce Now debuting in Brazil with Fortnite, League of Legends, and Among Us. Traditional gaming companies are moving more from console gaming to cloud gaming.

NFT Games and the Metaverse

Another trend is NFT-based gaming. NFT means non-fungible crypto tokens (NFTs). It is based on the same blockchain technology as cryptocurrencies. Investors’ interest in NFT-based games is growing. Ubisoft, Konami, Epic, Capcom, and EA are exploring NFT-based Earn-to-Play Gaming. Square Enix has announced its first NFT game, called SymbioGenesis. Ubisoft implemented its own platform called Quartz and its NFT game called Digits. Brazilian gaming company Prota Games launched an NFT and cryptocurrency-based computer game called Heroes of Metaverse. In Mexico, NFT gamers love to play Aliens Worlds, Gameta, Splinterlands, and Heroes Chained. According to MiT Software the most popular NFT video games in this Latin America are Axie Infinity, CryptoBlades, Upland, Aavegotchi, Lost Relics, Sandbox, Mobox, among others, and the most profitable NFT games are Mist, Iluvium, and Star Atlas.

NFT-powered games offer a bridge between blockchains and the metaverse. What is the Metaverse? The Metaverse is a parallel “universe” in 3D; virtual bubbles are made accessible with Virtual Reality (VR) headsets that allow you to see each other in 3D. Land and property in the metaverse are bought, built, and traded with crypto tokens. Gamers sell items, and earn a percentage from resales. However, Play-to-Earn is risky due to its volatility, because the value of these tokens fluctuates, and if players cash out and abandon a game, its value crashes.

NFT gaming is hot. However, with cryptocurrencies under heavy scrutiny from regulators and subject to changing laws that differ per country and per region, there is no safety guarantee for players who opt for games that pay out in crypto tokens. NFT gamers have to be well aware of the risks, while enjoying the ride.

iGaming and Online Gambling Legislation Across LATAM

According to Americas Market Intelligence (AMI) data, Latin America’s online casino and the betting sector will be worth some $10 billion in 2022, of which Colombia takes the largest slice ($4 billion). Regulations around online gambling vary across Latin America. Lawmakers in Bolivia and Nicaragua do not make any distinction between traditional and online gambling, while Argentina applies rules that differ per province.

Brazil, Mexico, and Colombia are ranked in the world’s Top 10 countries of origin of daily visitors to online casinos. Brazilians are so passionate about soccer that it shouldn’t come as a surprise that they love to bet on sports games. The two biggest Brazilian football teams (Flamengo and Corinthians) each have more than 30 million supporters. In Spring 2022, Brazil’s lawmakers regulated gambling by drafting a licensing system where operators must pay $4.4 million for a license that is valid for a maximum of five years. The Brazilian Chamber of Deputies authorized up to 31 land-based casino resorts, licensed riverboats, cruise ships, and gaming resorts in tourist areas. Grupo Globo published a study in which 78% of the respondents claimed to play roulette and blackjack in online casinos. What complicates matters is Brazil’s prohibition of using card payments for gambling transactions. Formally, the Brazilian law bank transfers and APMs like Pix, Sodexo, and Itaú Boleto. Some Casino operators also offer Moneygrator, a local one-click multiple payment method developed for casinos.

Mexico has the second-biggest economy in Latin America, and with half the population of Brazil, the gambling market is worth $300 million a year. Sports betting and casino gambling are extremely popular. Currently, there are dozens of sports betting and casino operators in Mexico, the majority of which are working with internationally licensed operating firms. Online operators must get a license from SEGOB (Secretariat of the Interior), and operators must pay a 30% tax rate from GGR earnings. Prohibitions around casino gambling are complex because they vary according to the type of game, and Mexicans are allowed to gamble online, but only with offshore-based sites. Licensing is organized around partnerships with traditional ‘land-based’ casinos. The Gaming Regulations of the Federal Law on Games and Raffles and the Dirección General de Juegos y Sorteos regulate both the online and the traditional gambling business, including online casinos. In Mexico, the casino market is regulated by the Directorate General of Games and Draws. The law allows card payments, bank transfers, OXXO, and CoDi.

Colombia became the first Latin American country to regulate online gambling back in 2016. The gambling tax is 15% of online gross gaming revenue (GGR), and operators pay a flat tax of $175.000. Online casino operators constantly expand their games portfolio. Many use APIgrator to integrate over 7000 games from over 100 licensed industry developers into one online casino platform. Colombia has a regulated, open online casino market. Online casinos are authorized, licensed, and closely monitored by Coljuegos. Online casino gamblers are allowed to pay with their credit and debit cards (Visa, Mastercard, Éxito, and Codensa), bank transfers (PSE), digital wallets, and cash (Efecty and Daviplata). Digital Wallets are extremely popular in Colombia, a country that is digitalizing its payment landscape at a remarkable pace.

In conclusion, the Latin American eGaming and iGaming market offer investors, gaming companies, and payment facilitators an exciting growing landscape full of business opportunities. However, it is extremely important to stay up to date about changing rules and regulations. Brazil, Mexico, and Colombia are the region’s largest (paying) eGaming markets, followed by Argentina. For companies looking for a secure payment services provider with years of experience in this vertical market, we suggest that you contact Segpay’s Sales Team for further free advice related to the topics discussed in this article.

Want to learn more about Online Gaming Payments?

Contact us today, we’d love to chat with you about accepting payments for online gaming. It’s another way we are here for our merchants All the Way to Paid ™. Reach out to us with your questions at [email protected]

Author @SandeCopywriter on behalf of Segpay Europe.