- 7 minute read

The digital payments landscape continuously evolves, which makes it challenging for merchants to stay ahead of the curve. As technology continues to reshape our world, several trends are emerging that redefine how consumers shop and pay in a secure environment. Let us explore five digital payment trends that are set to shape the future.

Alternative Commerce: Beyond Traditional Transactions

Alternative Commerce is redefining the concept of commerce itself, expanding beyond traditional transactions and incorporating novel ways of buying and selling goods and services. This trend includes various innovative payment models, such as renting, sharing bills and subscription-based services, peer-to-peer transactions, and even decentralized finance (DeFi) platforms.

Subscription-based models, popularized by content streaming services, are now extending to other industries. We have explored recurring subscription payments in several blogs over the past year. From SaaS subscriptions to product boxes, consumers embrace the convenience of automated subscription payments. Peer-to-peer transactions (e.g., Venmo, Tikkie, Zelle, and Cash App) are becoming the norm for splitting bills among friends.

Blockchain technology is transforming financial services, allowing users to lend and borrow without the need for traditional financial institutions. As Alternative Commerce continues to gain traction, we can expect a shift towards more inclusive and decentralized financial systems.

Payment Orchestration: Streamlining the Payment Ecosystem

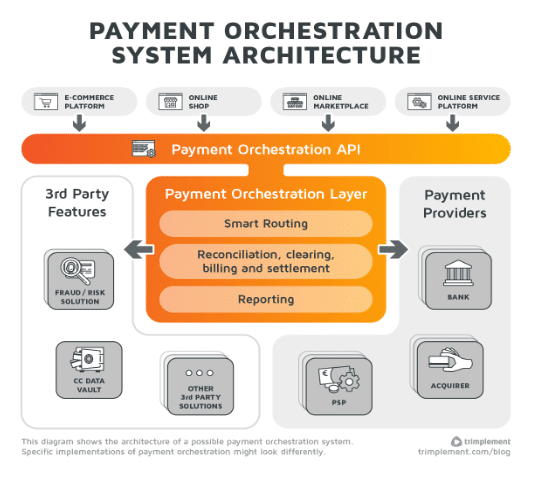

The complexity of the digital payment ecosystem has given rise to Payment Orchestration – a trend that focuses on simplifying and perfecting the payment process. What is Payment Orchestration? It is the integration of various payment methods, gateways, and processors into a single, cohesive platform. Large corporate businesses are increasingly adopting Payment Orchestration solutions. Whether credit cards, digital wallets, or even emerging cryptocurrencies, Payment Orchestration ensures that merchants can accept various payment options without the headache of dealing with multiple integrations.

This trend improves the user experience and helps merchants adapt quickly to changing market demands. As the digital payment landscape diversifies, Payment Orchestration will be crucial in ensuring flexibility and efficiency in transaction processing. Payment service providers benefit from payment orchestration by gaining flexibility, efficiency, and adaptability in managing diverse payment methods. It helps PSPs offer value-added services (VAS) to their merchants and helps them stay ahead of the competition in the ever-evolving payments industry.

The Metaverse: Digital Transactions in a Virtual World

The Metaverse, a virtual reality space where users interact with computer-generated environments and other users, is not just a realm for gaming and socializing – it’s becoming a hub changing how consumers shop and pay. As more aspects of our lives digitalize, the Metaverse opens a new space in e-commerce.

Virtual and cryptocurrencies within the Metaverse are gaining real-world value. Digital goods, such as virtual real estate, in-game items, and even digital art, are bought and sold using digital currencies. This trend creates new opportunities for businesses to monetize virtual experiences, blurring the lines between the physical and digital worlds.

Digital payments in the Metaverse are vulnerable to security and privacy breaches. As transactions occur in a digital environment, ensuring the safety of users’ financial information becomes crucial. Blockchain technology is expected to be crucial in addressing these security concerns.

Digital ID: The Key to Seamless Transactions

Traditional identity verification methods are undergoing a revolutionary transformation with the rise of Digital ID. This trend is about creating a secure and streamlined user experience by leveraging digital means to authenticate their identities.

One development in this area is the adoption of biometric authentication methods. Fingerprints, facial recognition, and even iris scans are becoming commonplace, providing a level of security that traditional passwords cannot match. Biometrics improves security and offers a more user-friendly and frictionless payment experience.

Blockchain technology is playing a pivotal role in shaping Digital IDs. Decentralized identity systems ensure individuals have control over their personal information, reducing the risk of data breaches. As Digital ID becomes more widely adopted, we can expect faster and more secure transactions, ultimately driving the digital payment landscape forward.

Biometrics: the Protection of Minors through Age Verification

Biometrics can also enhance internet safety for minors by providing secure and personalized authentication methods. Utilizing features like fingerprint recognition or facial scans, biometrics add an extra layer of protection, ensuring that only authorized users, such as parents or guardians, can grant access to minors. This minimizes the risk of unauthorized access to sensitive online content or platforms. Additionally, biometric authentication can replace or complement traditional age verification methods, making it more challenging for minors to surf and buy age-restricted products and services. Integrating biometrics makes the internet a safer space for minors, protecting them from potentially harmful or inappropriate content and interactions. This technology helps to create a more secure and age-appropriate online environment for young users.

Security and Privacy: Cornerstones of Trust in Digital Payments

Amidst the exciting developments in Digital ID, Payment Orchestration, Alternative Commerce, and the Metaverse, the importance of security and privacy cannot be overstated. As digital transactions become more prevalent, the need for robust security measures and respect for user privacy becomes even more critical.

Encryption technologies, multi-factor authentication, and tokenization are tools employed to safeguard digital transactions. Furthermore, regulations like GDPR and evolving data protection laws shape how businesses handle customer information, emphasizing transparency and accountability.

Conclusion

The digital payment landscape is undergoing a profound transformation, driven by the convergence of technology and changing consumer preferences. Digital ID, Payment Orchestration, Biometrics Security, Alternative Commerce, and the Metaverse are not just trends but powerful forces shaping the future of how we transact in the digital age. As businesses and individuals adapt to these changes, a secure and seamless digital payment experience is on the horizon, promising a more connected and efficient financial future.

Want to learn more?

If you want to know how Segpay can help your business stay ahead of the technological curve, please contact our team of experts.

Reach out to us with your questions at [email protected]

*******

This article was written by @SandeCopywriter on behalf of Segpay Europe