- 5 minute read

Brazil is home to 215 million people. PCMI calculates market size by including all merchant verticals, PC, mobile and in-app purchases, cross-border e-commerce transactions through locally issued cards and all card-not-present transactions, such as recurring payments. Based on this calculation, e-commerce in Brazil will reach US$274.5 billion in sales by the end of 2023, which represents 27% growth over 2022.

In the dynamic landscape of Brazil’s rapidly growing e-commerce market, the subscription economy has emerged as a powerful force, reshaping how businesses engage with customers and generate sustainable revenue streams. As consumers seek convenience and personalized experiences, businesses are turning to subscription models. A payment processor that is specialized in recurring billing can play a crucial role in making this model safe and successful.

Brazil's Massive Digital Adoption

Before we dive into the subscription payment models, let us have a quick look at some recent facts & figures as published by Data Reportal; figures that reveal the impressive state of Brazil’s massive tele-digital and social media adoption:

- Brazil has 221 million active cellular mobile connections (more phones p/person)

- 181.8 million internet users

- 152.4 million Brazilians are active on social media.

- Facebook has over 109 million users

- YouTube has over 142 million users

- Instagram has over 113.5 million users

- TikTok has over 82.21 million 18 plus users

- LinkedIn has over 59 million Brazilian members

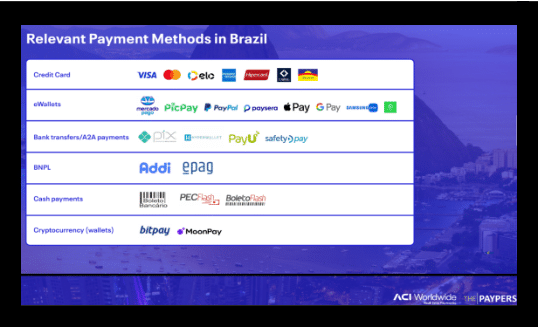

This will prove to be a main driver for Brazil’s Social Commerce, one of the trends we discussed in our 2023 Top 8 Digital Payment Trends analysis, at the beginning of this year. Social Commerce has tremendous potential in Brazil. This exciting market offers all stakeholders in the digital payments value chain immense business opportunities, but merchants that want to expand their business in LATAM’s giant must be able to offer Brazilians’ their preferred payment methods.

Brazil is home to some of the world’s most successful fintechs, such as pioneer PagSeguro and unicorns such as NuBank, StoneCo and C6 Bank. Sao Paulo has become the country’s main fintech Hub. Pix is yet another great example of the country’s digital maturity; Brazil’s instant payment platform that has been created and managed by the monetary authority of Brazil, the Central Bank of Brazil (BCB). For those readers who are interested in LATAM’s digital payments and e-commerce landscape, we refer to one of our earlier blogs about Merchant Business Opportunities in Latin America.

The Rise of Brazil's Subscription Economy

Now let us explore our main topic. According to PCMI analysis, the e-commerce market in Brazil will grow with a CAGR of 19.1% between 2022 and 2026 to reach US$435.4 billion. Brazil’s bustling e-commerce scene is experiencing a shift in consumer behavior. Traditional purchasing patterns are giving way to subscription-based services that offer recurring value to customers. From streaming platforms and meal kits to beauty products and software solutions, subscriptions are becoming the preferred way for consumers to access products and services.

This trend is not just a local phenomenon. Global market trends indicate that the subscription economy is gaining momentum worldwide. However, the unique characteristics of Brazil’s market make it particularly ripe for subscription-based models.

The Brazilian subscription economy has been growing rapidly. This business model rose 167% during the last four years, according to the E-commerce Brazilian Association (Associação Brasileira de Comércio Eletrônico, ABComm). Some of the major business categories that are contributing to the growth of the subscription economy in Brazil include:

- Streaming Services: Streaming platforms for video content, music, and gaming are significant drivers of the subscription economy in Brazil. Services like Netflix, Amazon Video, Disney, HBO Go, Globoplay, Claro Video, Tele Cine and Spotify offer subscribers access to a wide range of entertainment options.

- E-Learning and EdTech: With the increasing demand for online education and skill development, subscription-based e-learning platforms and educational technology (EdTech) services are gaining traction. These platforms offer courses, training, and educational materials on a subscription basis.

- Health and Wellness: Subscription boxes that provide health supplements, fitness plans, wellness products, and even meal kits have become immensely popular in Brazil. Customers value the convenience of receiving curated health and wellness products regularly.

- Beauty and Cosmetics: In a country whose culture emphasizes the importance of beauty and appearance, there is a great market for beauty subscription boxes that deliver skincare, makeup, and grooming products.

- Subscription Gaming: Subscription-based gaming services, such as those offering access to a library of games, are gaining popularity among Brazilian gamers. For further details, we refer to our previous blog about payment gateways for subscription gaming.

- Software and Productivity Tools: Subscription-based SaaS software, such as cloud-based productivity tools, project management software, and design software, offer businesses and individuals access to essential tools on an ongoing basis.

- Fashion and Apparel: Fashion subscription services provide customers with clothing and accessories based on their preferences. This allows subscribers to stay stylish without the hassle of shopping. This is especially appealing in a country with long distances between rural and urban areas, because it saves consumers a lot of travel time.

- News and Magazines: Digital news and magazine subscriptions provide readers with access to premium content, breaking news, and in-depth analysis, all delivered conveniently to their devices.

- Fitness and Wellness: Subscription-based fitness platforms offer virtual workouts, exercise routines, and wellness guidance, catering to individuals looking to keep an active lifestyle from the comfort of their homes. Brazilians love to stay in good shape.

- Legal Cannabidiol (CBD) Products: The demand for CBD-infused products has led to the emergence of subscription services for CBD oils, creams, and wellness products in Brazil. Brazil is an interesting market for licensed CBD merchants, a topic we explored into great depth in one of our earlier blogs about LATAM’s growing CBD market.

- Wine and Beverage Clubs: Wine and beverage subscription clubs provide customers with regular deliveries of curated wines, craft beers, and other beverages.

- Digital Services: Subscription-based digital services, including graphic design, website development, and content creation, cater to businesses and individuals seeking specialized services on an ongoing basis.

The Crucial Role of Payment Processors in the Growing Subscription Economy

A payment processor that specializes in recurring billing is instrumental in the success of merchants whose business depends on a secure subscription payment model. Here’s how such a dedicated PSP can make all the difference:

- Flexible Billing Solutions: Whether it’s monthly, quarterly, or annual billing, processors ensure that consumers have a variety of payment choices.

- Secure and Reliable Transactions: Trust is essential in subscription models. By providing the merchant with a secure payment gateway, sensitive customer data is protected. This increases consumer confidence and reduces churn.

- Recurring Billing Management: Managing recurring billing cycles can be complex. Payment processors streamline this process, ensuring that payments are collected accurately and on time.

- International Expansion: As Brazilian subscription businesses grow; they want to expand internationally. A global payment processor enables them to accept cross-border transactions and serve international customers seamlessly.

- Customization and Analytics: A PSP specialized in subscription payments offers its customers insights into customer behavior and payment trends through reporting tools. Data analytics is invaluable for businesses that want to optimize subscription offerings and improve their marketing strategies.

- Minimizing Churn: Churn is a challenge in subscription models. A specialized PSP helps reduce churn by offering flexible plans, easy cancellation processes, and quick issue resolution.

- Integration Capabilities: Modern payment processors seamlessly integrate with e-commerce platforms, making it effortless for businesses to set up and manage their subscription offerings.

Subscription payment models can be considered high-risk for several reasons, primarily due to the unique characteristics of the business model and the potential challenges associated with managing recurring payments. Here are some of the key factors that contribute to a high-risk classification:

- Chargeback and Dispute Rates: Subscription models often involve recurring billing, where customers are charged automatically at regular intervals. Customers may forget about their subscriptions and do not recognize the charges on their billing statements. As a result, subscription businesses might experience higher chargeback and dispute rates, which can impact their risk profile.

- Cancellation and Refund Policies: Subscribers may have expectations about the ease of canceling their subscriptions or obtaining refunds for services they no longer wish to use. Subscription businesses with unclear or rigid cancellation and refund policies can lead to dissatisfied customers and disputes.

- Customer Expectations: Subscribers expect consistency and quality from the services they are paying for. If there are any discrepancies or perceived lapses in service quality, customers may dispute charges or cancel subscriptions, leading to potential chargebacks.

- Subscription Renewal Transparency: It’s essential to clearly communicate renewal terms, pricing changes, and any upcoming billing to subscribers. Lack of transparency can lead to customer frustration and disputes, especially if subscribers feel they were unaware of renewal terms.

- Subscription Lifecycle Management: Managing subscription lifecycles requires careful attention to details such as billing dates, renewal notices, and changes in subscription terms. Failure to manage these aspects effectively can lead to disputes and chargebacks.

- Long-Term Commitment: Subscription models often involve longer-term commitments from customers. Long subscription durations can increase the chances of customer dissatisfaction over time, leading to cancellations and potential chargebacks.

- Billing Errors and Technical Glitches: Technical errors can result in incorrect billing amounts or unexpected charges. Billing errors can contribute to customer dissatisfaction and disputes.

- High Churn Rates: Some subscription businesses, particularly in certain industries, might experience higher churn rates, where subscribers often cancel their subscriptions. This can lead to inconsistent revenue and potential issues with chargebacks.

- Regulatory Compliance: Depending on the industry and location, subscription businesses might need to comply with specific regulations related to recurring billing and customer consent. Non-compliance can result in legal issues and disputes.

This is why it is critical to partner with a global payment processor that specializes in handling subscription models safely. Merchants feel more protected, and their high-risk business can be turned into low-risk business.

Conclusion: Brazil’s Bright Future for Subscription Payment Models

The subscription economy in Brazil reflects the ways in which consumer preferences evolve and the way agile businesses respond to customers’ changing needs. Payment processors stand as crucial enablers in this transformative journey, providing the infrastructure and expertise needed for subscription models to flourish.

As the e-commerce landscape continues to evolve, payment processors will continue to play a significant role in shaping the success of Brazil’s subscription economy. Through flexible billing solutions, secure transactions, and data-driven insights, payment processors empower businesses to deliver value, convenience, and personalized experiences to an ever-growing subscriber base. The symbiotic relationship between Brazil’s subscription economy and payment processors points towards a future where businesses and consumers thrive in a subscription-driven marketplace.

Want to learn more about your recurring payment processing options?

Contact us today, if your business depends on recurring billing and subscription models, please do not hesitate to email us your questions at [email protected] Our sales team will be happy to offer you free advice.

This article was written by @SandeCopywriter on behalf of Segpay International