- 10 min read

Over the past few years, millions of new consumers found their way to e-commerce. Globally, customers of all ages discovered the comfort of e-shopping and scrolling through marketplaces on the internet and compare products and services on their mobiles, iPad or laptops, without having to leave their homes. The value that has been spent via digital payments runs in the double-digit trillions of dollars. Acquiring banks, payment facilitators, fintechs and merchants are all in the race to meet growing demands. Today’s e-shoppers want a fast, efficient and seamless payment experience and the pressure is on merchants to provide their clients with secure and user-friendly solutions.

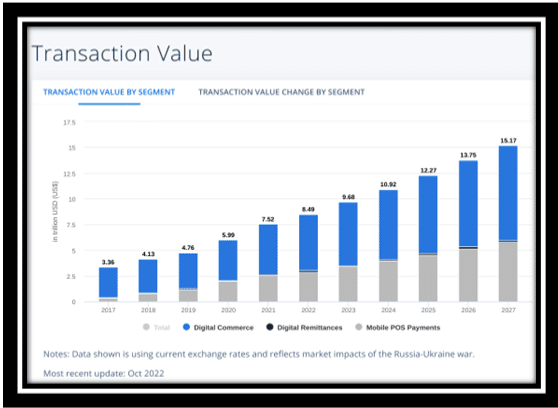

The digital payment market is expected to value over $15 trillion by 2027. Growth number are staggering and this Statista stat is based on transaction values of e-commerce transactions, mobile payments at point of sale (POS) and cross-border money transfers made over the internet (digital remittances). These figures don’t even include B2B transactions.

This shows us the enormous opportunities for stakeholders in the digital payments business and even though the cost of living is rising worldwide, e-payments are growing in popularity, while the use of cash is declining.

According to Statista:

- Digital Payments are expected to reach $9.68tn in 2023 in value

- At an annual growth rate (CAGR 2023-2027) of 11.88% resulting in a total amount of $15.17tn by 2027.

- E-Commerce transactions will value $6.15tn in 2023.

- Globally, the highest cumulated transaction value is reached in China ($3,831.00bn in 2023).

Card issuers, acquiring banks, payment services providers and merchants will have to stay on top of their game by understanding the trends that change and reshape the payment ecosystem; a landscape subjected to technological and regulatory changes.

Major Payment Trends

1. Social eCommerce

The APAC region has been a trendsetter for both social commerce and live commerce shopping. A quarter of APAC shoppers have used live streaming while shopping on the internet and one third has tried Virtual Reality (VR) shopping. Half of the region’s e-shoppers are familiar with the Metaverse, a trend that we will explore into greater detail in the future. Asian shoppers are leading the way, surfing through social media channels to compare prices and buy products and services online.

In a global, interconnected world, this trend was bound to reach Europe and the US. According to a recent report published by Global Payments, global Social e-Commerce sales reached $492 billion in 2021, a number expected to nearly triple by 2025. What is Social e-Commerce? When products and services are sold directly on social media platforms (i.e. Facebook, Instagram, Pinterest, TikTok, WeChat, etc.) this is called Social e-Commerce. Merchants are discovering the tremendous potential of Social e-Commerce and have started to include this in their omnichannel sales strategy to reach their target audience.

Social media platforms offer merchants the possibility to create brand awareness and sell their products to specific target groups. This strategy may include Live commerce, where influencers show their products during Live streaming and customers are ‘seduced’ into buying products and services via Buy links or QR Codes through a mix of commercial and social entertainment which appeals to younger generations.

2. Mobile e-Wallets, Contactless Tap to Phone and QR Codes

Mobile commerce (m-commerce) makes up 73% of the total e-commerce market and this share is expected to increase as 4.4 billion global consumers will shop with a digital wallet by 2023. E-Wallets have already become a standardized form of digital payments in Asia-Pacific (APAC) where nearly three quarters of all e-commerce transactions are paid with e-wallets by 2025. Led by Alipay and WeChat Pay, e-wallets accounted for 83% of e-commerce transaction in China in 2021 and e-wallets are quickly gaining in popularity in India (45.4%), Indonesia (38.8%) and the Philippines (30.5%), with regional wallets like GCash, GrabPay, LINE Pay, OVO and Paytm. E-wallets are also becoming popular in Latin America, as we have learned while exploring merchant business opportunities in Latin America.

E-Wallets are not yet as popular in the USA as they are in APAC. Card payments are still the preferred payment method in North America, but optimists expect that one third of US e-commerce will be paid with Apple Pay, Amazon Pay, Google Pay and PayPal or with digital banking wallets by 2025. American shoppers recognize the benefits of buying both in-store and online with a few clicks on their smartphones.

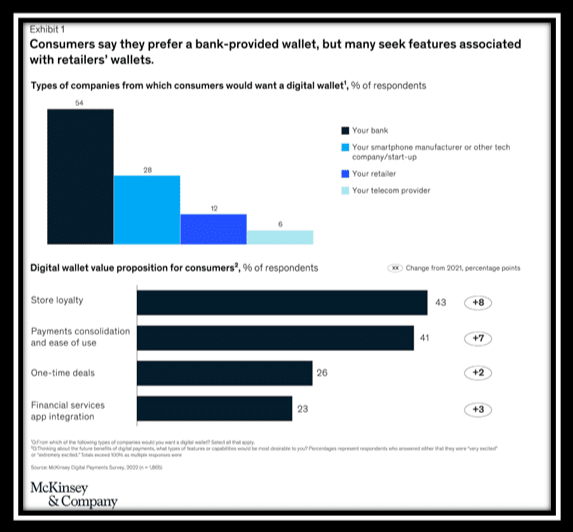

Interestingly, a recent McKinsey survey revealed that American consumers rather use digital wallets provided by their bank, but they want features and services that are mainly offered by retailers’ wallets. This means that banks will have to step up their game if they don’t want to lose the race against Bigtech and Fintechs.

Consumers are looking for e-wallets with embedded value-added services such as loans, BNPL, wealth management, debit and credit card payment methods.

With mobile penetration rising worldwide, mobile payment methods are bound to conquer e-commerce, POS and remittance markets, especially in those regions where a large segment of the population is unbanked. Small and medium businesses (SMB) can accept payments directly from the client’s smartphone through near-field communication technology (NFC). Discover Global Network forecasts that the tap to phone market will grow to $76.3 billion at a 23.4 percent CAGR from 2021 to 2025. SoftPOS (Software Point of Sale) transforms smartphones into payment terminals and all Android (Google Pay) and Apple i-phones i(Apple Pay) are NFC enabled.

Paying through QR codes is yet another trend in the m-payments space. Clients scan the QRC with their built-in camera and an app takes them to the checkout page. Examples of companies that offer QR payment apps that are popular in Europe and the US are PayPal, Revolut, Square, SumUp and Zettle. According to Insider Intelligence, retail m-commerce sales will cross $728.28 billion by 2025.

3. Embedded Payments

Super apps, embedded payments, or Payments 4.X solutions are part of the payment trend that copies China’s instant messaging, social media and mobile payment tool WeChat. Open finance encourages data-sharing between financial and nonfinancial providers. This opens the gate for businesses from any sector to let their customers pay, transact, or borrow without leaving their website or app. Payment services providers and merchants will have to be aware of this trend if they want to stay in the race. Vodeno surveyed more than 750 retail decision-makers across the UK, Germany and Belgium. Three quarters of the respondents offer embedded finance products on their platforms, such as credit cards, ‘Buy Now, Pay Later’ (BNPL) schemes and loyalty incentives and over half of these retailers will broaden their offering in 2023. BNPL platforms offer embedded lending for B2C businesses and travel operators offer insurance. The hype around embedded finance has been dominated by firms like Klarna of Sweden, Australia’s AfterPay (bought by Block in 2021) and USA-based Affirm. In the US, the embedded lending industry is predicted to grow at a CAGR of 27.5% in the coming years to top $200 million by 2029. According to a forecast published by Edgar Dunn & Company, the value of the market for embedded finance is expected to triple by the end of the decade – growing at 19% a year, to a value of $761 billion by 2029 (from $236 billion in 2022).

4. Buy-Now-Pay-Later (BNPL)

In the US, the total value of BNPL loans grew from $2 billion to $24.2 billion in just two years. According to Fortune Business Insight, the global BNPL market is projected to grow to $90.51 billion by 2029, at a CAGR of 21.7%. Other data sources are even more optimistic.

There is a lot happening in the BNPL business. Fintechs are leading, with PayPal Credit, Afterpay, Affirm, Klarna, Zip Pay, Quadpay, Uplift, Perpay, Sezzle, Zebit, and Splitit competing for the biggest share. Pioneer AfterPay offers its clients the possibility to add a virtual AfterPay card to their digital wallet. By simply tapping their smartphone at the POS terminal, shoppers take their product home and pay over the course of 6 weeks with no interest or fees, just as they would online. Affirm and Klarna launched physical cards and Apple launched Apple Pay Later. Affirm announced that it would fuse BNPL and Crypto to attract crypto-savvy users and card issuers don’t want to miss out on this hype either. American Express, Chase, and Citibank have launched and expanded BNPL programs in which cardholders can divide larger purchases into payments for a fixed monthly fee and no interest charges. BNPL fintechs offer reward programs to compete with banks.

Most BNPL companies earn financing fees (ranging from 2% to 8%) from the merchant. Social Media is an important marketing channel for BNPL payment solution providers. Klarna, launched a platform to match merchants with influencers who have access to their target audiences. Sponsored influencers promote BNPL and affirm its inclusion of the cardless and underbanked, without warning consumers for the risk of overspending beyond their budget. Particularly Generation Z loves BNPL and many youngsters are not aware of the fact that BNPL offers less consumer protection than card payments. BNPL providers aren’t subject to the same scrutiny as banks, because depending on the business model, some forms of lending are not covered by the Dodd-Frank Acts. Nevertheless, BNPL seems to be here to stay.

5. Open banking and Real-Time Payments

After the client’s consent, Open Banking gives third-party payment companies access to banking information, including transactions and payment history. This has widened the competitive landscape for financial institutions as it paved the way for a growing number of innovative payment start-ups. The global implementation of the ISO 20022 messaging standard will be rolled out globally in March 2023. This will facilitate further interoperability between domestic and international payment systems, including real-time cross-border payments and enhance security and compliance.

SEPA

36 European countries signed up to the centralized instant SEPA credit transfer (SCT Inst) scheme which offers multiple clearing and settlement. Cross-border transactions between EU member states have become fast, secure and efficient. SEPA also paved the way for real-time payments within the EU.

In the Netherlands, Belgium and Germany, Tikkie is used by 8 million people to send instant payments to friends, groups or businesses via WhatsApp, email, SMS or a QR Code. The payer only needs a smartphone linked to a bank account that enables iDEAL bank transfers. In the Netherlands, iDEAL is the most popular online payment method, more popular than CNP card payments.

Bizum is an immensely popular mobile Instant Payment method for millions of consumers with a Spanish Bank account. In 2016, 27 Spanish banks joined efforts to create Sociedad De Procedimientos De Pago S.L. with an initial investment of 2.8M€. Their original social object was “The creation and operation of a common directory in which IBAN numbers of bank accounts are linked to an identifier“. 6 years later, Bizum covers 95% of the market.

Besides Tikkie and Bizum, similar solutions exist in Denmark (MobilePay), Sweden (Swish), Norway (Vipps), Portugal (MB Way), Italy (Bancomat), Germany (Kwitt), UK (PayM) France (PayLib), Poland (Blik) and Switzerland (Twint). Way (Portugal). What’s so unique about Bizum is the fact that all the banks that operate in Spain have collaborated to create one instant payment solution.

Pay UK is planning a replacement with the New Payments Architecture (NPA) and in Scandinavia, Project 27 (P27) is building a single pan-Nordic payments infrastructure for the region’s 27 million inhabitants which facilitates secure, real-time payments between Denmark, Finland and Sweden and possibly Norway.

Inspired by the Europeans, the U.S. Federal Reserve is developing a new real-time payments and settlement service called FedNow which is expected to launch in 2023 with the (pilot) participation of 110 financial institutions. The Faster Payments Council is working together with industry stakeholders to improve real-time payments domestically and internationally. Almost three-quarters of the world’s population will soon have access to instant payments. According to Fintech Futures, the real-time payment market growth is expected to reach an impressive USD86.89 billion by 2028, standing for an estimated CAGR of 32% from 2022 to 2028.

This global trend should be a clear wake-up call for the major card schemes.

6. Biometric Identification and Authorization

The Fast Identity Online (FIDO) Alliance is an open industry association with a focused mission: authentication standards to help reduce the world’s over-reliance on passwords. PINs and passwords have been a headache for millions of digital, tech-savvy users. This is why a growing number of people are willing to prioritize comfort over the privacy concerns that biometrics raise. Biometrics relies on the storage and recognition of very sensitive, unique and private data such as a person’s iris, fingerprints, voice, face, signature, keystroke or palm.

According to a Global Payments survey, one third of the respondents indicated that payments using biometric identification and authentication will be the top commerce and payment trend of 2023. Nearly a fifth reported they will invest in enabling biometric identification and payment authentication in the year ahead.

In the US, PayPal, Bank of America, Wells Fargo, Best Buy, Wayfair and eBay already use biometric authentication. Amazon introduced Amazon One in 2020, where customers use the palm of their hand to confirm their identity before purchase. For many consumers, it is less intrusive to allow Amazon to store one’s palm than one’s face or iris. Millions of Chinese shoppers already pay through facial recognition, but in Europe and the US the public is much more concerned about possible misuse of very personal data. What happens if these databases get hacked or if governments change into tyrannies and individuals are subjected to extreme state vigilance?

Regardless European and American reluctance to share their most private physically unique features, iris-based biometrics is a technology that cannot be ignored. IrisGuard already developed the EyePay Phone, which enables consumers to get access to financial services after a quick mobile eye scan. Biometrics evangelists claim that the holy grail against rising fraud figures lies in the development of a protocol that combines biometrics and key cryptography for secure customer identification (KYC).

Neither the US Federal Trade Commission (FTC), nor the European Parliament is very much in favor of facial recognition surveillance technologies and while the European Parliament voted for a ban on biometric mass surveillance and the use of private facial recognition databases,, the European Banking Authority (EBA) allows the implementation of biometrics for the benefit of ID verification within the legal boundaries PSD2 regulations.

7. Cardless Bank Transfers

Merchants are increasingly pushing Pay by Bank at checkout to avoid card swipe fees. Bank of America and Citi are shareholders in Banked, a fintech start-up that allows merchants to accept payments from customer bank accounts without intermediates and UK-based player GoCardless processes more than $US30 billion in more than 30 countries each year.

iDEAL has been the most popular payment method in the Netherlands for years now. There is no chargeback risk and bank-to-bank transfers are settled instantly. IDEAL also uses QR Codes that take shoppers directly to their mobile or desktop Bank app during checkout. IDEAL is so fast and user-friendly that Dutch e-shoppers prefer this method over card payments.

Bank transfers are also leading in Poland, with BLIK earning over half of all e-commerce transaction value. This payment method is so user friendly that card orgs and payment facilitators should be aware of this trend and its growing market share.

8. Regulators scrutinize consumer interest and merchant swipe fees

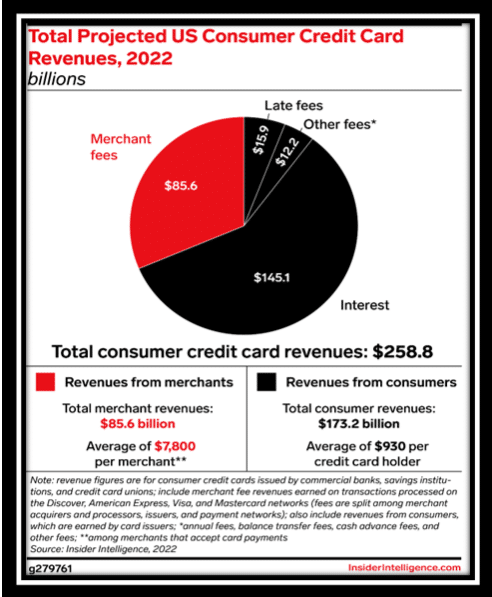

Last, but not least. Almost $260 billion in credit card revenues are at stake, as regulators are zooming in on fees. According to Insider Intelligence, card issuers should prepare for increased consumer credit card switching as the Consumer Financial Protection Bureau (CFPB) proposed swipe fee legislation on interest rates. Issuers will have to share consumer data with other providers at customers’ request. This will have a profound impact on card issuers’ competitive landscape.

Another payment trend that we have not discussed is the ability to pay for e-commerce with cryptocurrencies. This trend has been the subject of a Crypto blog that Segpay has published in October. The ability to offer Merchants Value-Added-Services (VAD) will also become increasingly important for payment facilitators to win customer loyalty. Then there is the Metaverse, a hot trend that we will explore in a future blog.

There are many payment, regtech and fintech trends that we have not discussed in this long-read. If there are trends that you would like us to explore and write about, please don’t hesitate to let us know. What we do know is, that it is crucial for decision-makers to stay updated about trends and business opportunities in growing markets around the world. Some trends may represent exciting opportunities, while others may represent a threat in an increasingly competitive digital payments landscape.

Want to learn more about Payment Trends?

If the payment trends that we have explored in this study have made you curious or raised any questions, our Segpay’s experts are there to offer you the best possible advice.

Researched and written on behalf of SEGPAY by SandeCopywriter