- 5 minute read

Many Latin American countries already regulated the legal use of CBD oil or cannabis-extracted medicine or are in the process of drafting laws that regulate the production, sales and export of hemp-based products.

As we explained in our previous article about business opportunities in the European CBD market, cannabis oil is extracted from hemp and hardly contains any traces of THC, the psycho-active substance in marijuana and hashish that is present in the female cannabis plant. Therefore, CBD does not alter the user’s state of mind. CBD exhibits properties that are considered beneficiary against anxiety, pain, and sleeping disorders. CBD oils, vapor, lotions, cosmetics are sold in shops or through e-commerce, and cannabis-based medicine is prescribed by doctors to fight rare types of epilepsy, MS spasms and nausea, caused by chemotherapy. In countries that regulated CBD medicine, patients receive prescriptions which allow them to buy these medicines from licensed pharmacies or from foreign legal distribution channels.

Positioned behind its North American neighbors and the EU, Latin America has great potential to become the fastest growing CBD market in the world. According to research company Statista, Latin America’s legal cannabis market is expected to grow substantially in the coming years and is projected to reach $44.8 billion by 2025.

Investors, CBD start-ups and international players have discovered this exciting region. Some of the international CBD companies that operate in Latin America include Khiron, CBD Life, ReMederi, Pharmin, Elixinol Ltd., Isodiol International Inc., Leef Organics Ltd., Kapu Maku LLC, CBD Skincare Company, Endoca BV and PharmaCielo. Not all CBD companies produce cannabis-based medicine. Many focus on the wellness and cosmetics market. Cannabis-based medicine is manufactured in an increasing number of licensed laboratories that do research to discover the medical properties of cannabis. Now let us explore some of Latin America’s most promising markets.

Colombia, a fertile regulatory climate for profitable Cannabis business

In 2017, Colombia legalized the cultivation of hemp for medical purposes as well as the purchase of prescription-based cannabis medicine from licensed pharmacies. According to the US Foreign Agriculture Service, the Colombian government authorized 968 licenses to produce cannabis and hemp in 2020. During the first nine months of 2021, another 350 licenses were distributed. Colombia does not make any distinction between cannabis and hemp but uses the term “psychoactive” (maximum 1% THC content) to distinguish between the two.

Colombian authorities give out two types of cultivation licenses

• The legal cultivation of psychoactive cannabis plants (THC of 1% or higher)

• The legal cultivation of non-psychoactive cannabis plants (THC less than 1%)

Companies that receive cannabis cultivation licenses must allocate 10% of their profits to Indigenous people and other groups that have been affected decennia of drugs-related violence.

Colombia’s hemp industry continues to attract U.S. and Canadian investors. 70% of cannabis companies have received foreign investments with a total value of $400 million.

The first US and Canadian companies to operate in Colombia were:

- New York-based investment firm Northern Swan, via its investment in Colombian cannabis company Clever Leaves.

- Subsidiaries or joint ventures of Canadian licensed producers, including Ontario-based Canopy Growth, Alberta-based Aurora Cannabis, Ontario-based Aphria and Ontario-based Cronos.

- Companies publicly listed in North America with main operations in Colombia include PharmaCielo, Khiron Life Sciences, Blueberries Medical and Avicanna

Colombia has drafted international trade regulations for medical marijuana, CBD and other cannabinoids under a resolution which has been adopted in spring this year. The new rules allow licensed companies to grow hemp for industrial purposes and to commercialize a wide range of cannabis derivatives including dried flowers.

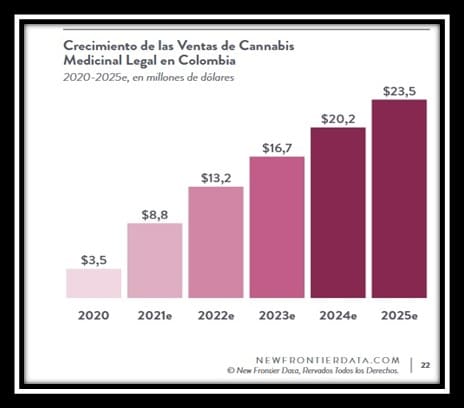

According to the latest report by IMARC Group, titled “Colombia Hemp Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027,” the Colombian hemp market is expected to exhibit a CAGR of 20.1% during 2022-2027. A study by Market Research company New Frontier Data estimates that the Colombian legal cannabis market will value $16.7 million in 2023 and $23,5 million in 2025.

Key players in the Colombian CBD market are:

- Avicanna Inc.

- Cannabco Pharmaceutical Corp Colombia S A S

- CBDINC Group

- CBD Seed Co (Hemp Depot)

- Clever Leaves

- Colombian Hemp Company

- Khiron Life Sciences Corp.

- One World Pharma Inc.

- PharmaCielo Ltd

- Sky Hemp Organic.

Legal Cannabis Medicine Sales in Colombia

Back in 2019, Khiron Life Sciences Corp., a Colombia-based integrated cannabis company announced a partnership with U.S.-based cannabis company Dixie and Canadian-owned, Colombia-based cannabis company PharmaCielo as part of a cross-border cannabis supply chain. Health Canada, the government’s public health agency that monitors the medical cannabis industry issued six authorizations to Clever Leaves, allowing the company to import a sample of dry cannabis flower from Colombia, into Canada for scientific purposes. This was the first time that a Colombian company was allowed to export native-grown cannabis legally into another country. Pharmacielo presently exports its cannabis-based products to 13 countries.

Three years later Colombia-based market leader CannabCo Pharmaceutical announced the completion of an economic impact assessment. CannabCo farms and extracts non-psychoactive cannabis and hemp flowers to produce CBD oil for the medical cannabis market. The company has acquired EU GMP status, which gives CannabCo access to the global pharmaceutical market. Committed to produce the highest quality of medical grade cannabis products in the industry, CannabCo also participates in social and educational programs to promote its high ethical standards. These are just a few examples of the enormous potential that Colombia has as a Latin American hub for the production of cannabis-based medicine.

Mexico, a regulated market full of exciting opportunities

In November, 2015 the Mexico’s Supreme Court ruled that the prohibition of cannabis is unconstitutional, stating that it violates the fundamental right to the free development of the personality. This groundbreaking rule was repeated for a fifth time in October 2018. CBD has been legal in Mexico since 2017, when President Peña Nieto signed a bill that legalized the cultivation, production, and use of medical cannabis products with a maximum 1% THC threshold.

In March 2021, the Chamber of Deputies approved the Cannabis General Law and sent it to the Senate for final approval. Legislators established a legal framework meant to regulate and monitor the production of medical cannabis closely. Licensed laboratories must comply with strictly defined sanitary rules and record their provisions. The heavily regulated Mexican CBD market is quite similar to Canada’s regulatory landscape. The Mexican CBD industry is regulated by COFEPRIS (Mexico Food and Drugs Agency) and by the Federal Commission for the Protection against Sanitary Risk. CBD products that are exported or imported and sold in Mexico must meet the criteria outlined by COFEPRIS. The legal cultivation of cannabis is supervised by SENASICA and the import and export of is regulated by COFEPRIS that authorizes specific sanitary licenses. Only licensed pharmacies or drug stores are authorized to sell prescription-based cannabis medicine. According to the latest data published by the Mexican Institute of Industrial Property (IMPI), there are 549 registered trademarks for cannabis products. The Prohibition Partners platform predicts that cannabis revenues in Mexico could value more than $2 billion by 2028.

This summer, COFEPRIS and the US Federal Drug Administration (FDA) approved the research of a molecule extracted from CBD oil and developed by Tec de Monterrey and the Cardiol Therapeutics and its use to treat COVID2 patients. “We have been researching this molecule for 10 years. In the first phase, we saw that CBD decreases the anti-inflammatory immune response, which is why, in the midst of the pandemic, we were looking to use it on patients with Covid-19 and cardiovascular diseases,” explains Servando Cardona, national director of Clinical Research at TecSalud.

CBD market leaders in Mexico:

- HempMeds Mexico

- CBD LIFE SA DE CV.

- CBD Science

- NuLeaf Naturals, LLC

- ELITE CBD MEXICO

- Lazarus Natural

- Pure KANA

- Tonic CBD

Mexico is a great example of a country where clearly defined CBD regulation offers businesses a transparent legal framework to operate in, whereas countries with opaque legislation generate much uncertainty. Confusion that forms a major obstacle for international and local CBD companies and for investors, eager to profit from lucrative opportunities in a region with the perfect soil and climate for the cultivation of cannabis.

Brazil, a promising CBD market, impacted by restrictive regulatory changes

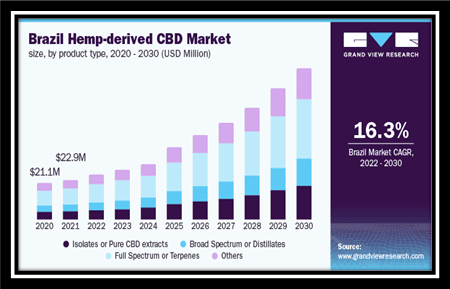

One example of regulatory changes that have had a negative impact on a budding industry is Brazil. Latin America’s giant with over 210 million inhabitants has the potential to become the largest CBD market in the region, if it wasn’t for a new resolution that has caused a lot of uncertainty amongst consumers, business stakeholders, doctors, and their patients. The new law restricts cannabis-medicine treatment to very rare epilepsies: Dravet and Lennox-Gastaut syndrome. This new resolution has alarmed doctors and almost 200.000 Brazilians who rely on cannabis medicine.

All eyes are on Brazil’s new government that is expected to be less restrictive. The President will appoint the heads of the Health Ministry, Agriculture Ministry, and ANVISA (Brazil’s FDA). These bodies have regulatory autonomy to legalize specific use of cannabis in Brazil. Previous to this resolution, the Brazilian hemp-driven CBD market was expected to grow with a 16.3% CAGR, but this all depends on Brazil’s new legislators.

Paraguay: “Hemp, a crop of national interest”

This may come as a great surprise to many, but Paraguay is one of the largest exporters of chia, pine nuts and hemp in the world and the largest exporter of hemp seeds in Latin America. In 2021, the export value of Paraguayan hemp seeds valued $65.21 million.

Paraguay legalized medical cannabis in 2017, industrial hemp in 2019 and in 2020, President Mario Abdo Benitez declared hemp “a crop of national interest”. The government announced a national program, devoted to the research, development, and commercialization of industrial hemp. Paraguay took a novel approach by allowing only pharmaceutical laboratories to apply for licenses.

Paraguay’s cannabis legislators established a limit of 0.5% delta-9 THC on a dry weight basis. Only licensed Companies are authorized to grow hemp and export exports hemp flowers, seeds and derivative products to several European and North American countries. The government offered illegal cannabis farmers much better working conditions and more income if they participate in the legal cultivation of hemp. The government provides these farmers with seeds in cooperation with private companies.

One of the first laboratories to import CBD for medical use was Laboratorios Lasca, which manufactured and distributed a registered medical cannabis product with a concentration of 25 mg per milliliter of CBD, prescribed to alleviate refractory epilepsy, muscular spasticity, and pain. Then then is the local ImproLabs Cannabis Medicinal. The Ministry of Public Health and Social Welfare received 126 products derived from Medicinal Cannabis (PRODOM-CANNABIDOL. CBD) from the COMFAR SAECA Laboratory as part of the National Program for the Study and Medical and Scientific Research of the Medicinal Use of the Cannabis Plant and its Derivatives.

According to the Argentinian media outlet Perfil, medical cannabis exporter CPlant Switzerland aims to buy a licensed producer in Paraguay to grow cannabis flowers and derivatives for the company’s Swiss laboratory. Argentinian founded CPlant could move most of its cultivation from Uruguay to Paraguay, where operating costs are 50% lower than in Uruguay. CPlant ships the CBD-rich dried flower to its laboratory in Switzerland, where it is processed into packaged products for sale to distributors in Latin America and the EU. Sales of strictly medicinal cannabis in Europe are expected to reach some US $ 2.6 billion in 2026. These are just a few examples of Paraguay’s great potential as a Latin American medical CBD hub.

Most of CBD-based products are sold via e-commerce. CBD merchants need to partner with the most cost-reductive, secure and reliable PSP. Segpay has a proven track record in providing legal CBD companies with secure payment services in compliance with local legislation. Do not hesitate to contact our international Sales people who can explain to you what value-added-services Segpay has to offer international merchants in a broad variety of business verticals, including the profitable, budding CBD business.

Want to learn more about CBD payment processing options?

Contact us today, we’d love to chat with you about processing payments for CBD. It’s another way we are here for our merchants All the Way to Paid ™. Reach out to us with your questions at [email protected]

Author: @SandeCopywriter on behalf of Segpay International