- 5 minute read

What is the EU Digital ID Wallet?

In 2016, the EU launched eIDAS (electronic identification and trust services) to build the foundation of a legal and technological framework for cross-border electronic identification, authentication, and website certification within the EU. In our previous blog about biometrics and payments, we spoke about eIDAS.

eIDAS marked the beginning of a complex cross-border initiative that will lead to the development of a secure EU Digital ID Wallet, made available for citizens in the 27 EU member states. Currently, only 60% of EU citizens in 14 member states can use their national digital ID cross-border. The EU Digital ID Wallet (eID) will change this situation.

The European Union plans to release its biometrically secured eID in 2024. This eID is meant to become an all-in-one digital identity gateway to access public and financial services. EU residents will be able to store their digital identity, driving license, bank account(s), pension plan, social security, medical insurance, etc. inside one secure eID. Many EU countries already implemented digital ID certificates, but the EU eID takes identification to another level.

The eID serves as:

- Online and offline identification

- Storage and exchange of personal data provided by governments

- Proof of the right to reside, work, study, get their pension and have access to health care in an EU Member State

- Storage of the owner’s driving license

- ID to rent a vehicle

- ID to check into a hotel

- Tool to request a birth certificate

- Storage medical certificates

- Proof of vaccinations status

- Tool to report a change of address

- ID to open a bank account or apply for a loan, mortgage, etc.

- File income tax/tax returns

- Storage of medical prescriptions (valid throughout the EU)

- Confirmation of age (in case of age restrictions)

- Authorization for cross-border payment transactions

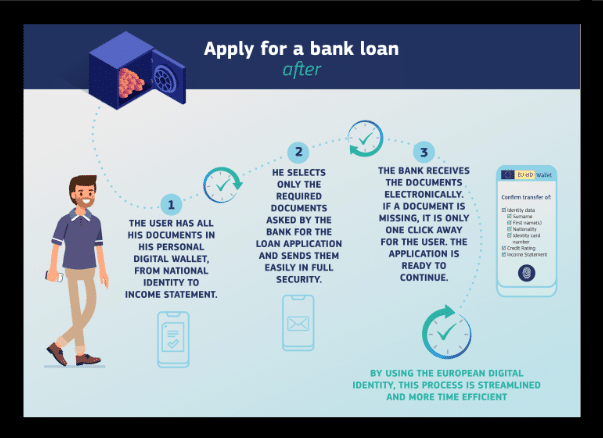

The picture shows how an EU citizen will be able to apply for a loan with the eID.

Although the EU promises that citizens will not be obliged to use the eID, there are strong incentives for its widespread adoption across the eurozone. The eID will be promoted as a secure wallet for official documents, all stored in one place. This relieves its owner from having to carry around important documents and of having to remember multiple passwords. This offers a sense of security. They will be asked which personal details they choose to share, in order to be able to access specific services. EU citizens will be tempted by the idea of having more control on the privacy of their sensitive data, while reaping the benefits of an all-in-one storage wallet.

It will be hard to resist an app that offers EU citizens quick and simple one-step ID verification to access public and commercial services within the EU, in addition to a sense of security when authorizing digital transactions.

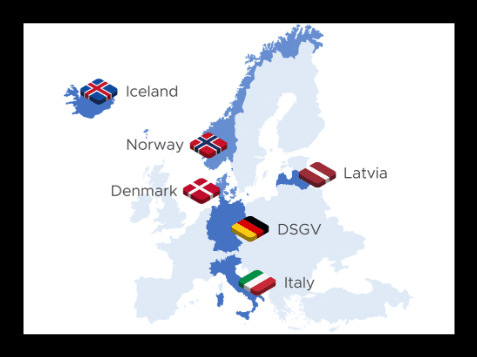

Multi-Country NOBID Consortium

The Nordic-Baltic eID (NOBID) Consortium – a collaborative effort involving trusted experts in Denmark, Germany, Iceland, Italy, Latvia and Norway – is trusted with the development of the eID. The Consortium will receive funding from the EU Commission´s DIGITAL Europa Program.

This pilot is launched in March 2023. The first phase consist of a cross-border payments pilot that will be developed by some of Europe’s most trusted identity experts. Its implementation will leverage existing payment infrastructure to enable payment issuance, instant payments, account-to-account transfers, and payment acceptance both in-store and online, ultimately leading to the all-in-one eID wallet.

What are the eID's Benefits for the Financial Institutions?

What are the benefits of this European initiative for banks, fintechs, payment services providers, merchant acquirers and other FIs involved in the payment ecosystem?

Customer Identification Programs

One unified eID will improve workflows, as implemented by Risk Management and Compliance departments. Due Diligence, Know Your Customer (KYC) and anti-Money Laundering (AML) processes will become faster and much more efficient. One eID optimizes customer retention and checkout rates, because customer onboarding, ID verification and authentication procedures become fast, frictionless, and dummy proof.

Improved Cross-Border Payment Experience

The cross-border payment experience will be much simpler, which will improve customer satisfaction rates. The eID also helps to simplify age verification as part of the euCONSENT initiative. Digital Payment Fraud figures will drop and both customers and financial institutions are more protected against financial criminals.

PSD2, SCA and Fraud Prevention

One secure digital EU eID helps to combat ID Fraud. An eID for all EU citizens that complies with EU rules and regulations, 3D Secure protocols and Strong Customer Authorization (SCA) as dictated by the EU Payment Directive (PSD2) simplifies business processes for FI’s that operate in the EU region. For further information, please read our blog about PSD2 and Open Banking.

Building Trust

EU citizens can specify which data they want to share with third parties. This creates trust between buyers and sellers. EU Citizens will be able to sign documents with a Qualified Electronic Signature (QES), while being offered the highest possible proofing and security guarantees. The EU promises its citizens that they will remain in control of their personal data and that each user will be able to choose which elements of their identity they choose to share with financial institutions, government institutions, insurance companies, hospitals, car rentals, etc.

Resistance against one unified EU ID & Wallet

If the EU promises its citizens “a rose garden” one might think, why the resistance? Critics claim that not everything that shines is gold and even though the vast majority of the EU state members voted in favor of the eID initiative and for all the good reasons we have mentioned here, a number of industry experts and EU politicians have expressed strong concerns about EU citizens’ privacy and data security. With all private data stored in one eID wallet, the consequences of a data breach or an attack by cyber criminals are huge. What, if hostile foreign entities get access to private data of 450 million Europeans?

There have been debates amongst lawmakers inside the EU member states and even though Members of the European Parliament’s (MEPs) Industry, Research and Energy Committee have given their support to a new digital identity framework by 55 votes against 8, there have been critical voices in the EU Parliament about the eID’s as an oppressive “Big Brother” tool that leads to the potential “Chinafication” of Europe.

German MEP, Christian Terhes “Clearly, we are witnessing right now, the Chinafication of Europe because we see what is happening in China right now with the social credit score, where the government is monitoring all the people… They control everything and watch everything. This is an example of tyranny.”

Dutch MEP, Rob Roos said: “How voluntary is the European Digital Identity Wallet?” Even though most of the Dutch parliament voted against the eID Wallet, the Netherlands voted in favor of the initiative in the EU, which according to some lawmakers is unconstitutional.

Google and Mozilla also object to new EU trust certificates, claiming that these certificates would be less secure and technically challenging to implement. Trade groups are concerned about the time/cost efficiency of having to integrate the eID with their own infrastructure.

Notwithstanding the objections of MEPs and the critical voices from within EU member states, a majority of the EU voted in favor of a unified digital EU ID Wallet. The future will learn the outcome of this European initiative. We will keep you posted!

Want to learn more about the EU Digital ID Wallet?

If you have any doubts or questions about the consequences of this EU initiative for your business, get in touch with one of our global payment experts.

Contact us at [email protected]

This article was written by @SandeCopywriter on behalf of Segpay Europe.