- 5 minute read

Reporting is the process of presenting data from many different sources. Transparency and user-friendliness are key. Analytics tools examine large amounts of data to obtain actionable insights that can be used to improve business performance. Analytics aims to draw conclusions based on real-time data, while reporting tools transform and organize data into meaningful information.

In the fast-paced and competitive world of e-Commerce, the absence of reporting and analytics tools exposes merchants to myriad risks that can have far-reaching consequences for their businesses. These tools serve as the eyes and ears of a merchant’s operations, providing crucial insights into customer behavior, transaction patterns, and overall business performance. This is even more critical for high-risk merchants. High-risk merchants operate in industries or sectors more susceptible to chargebacks, fraud, and regulatory scrutiny.

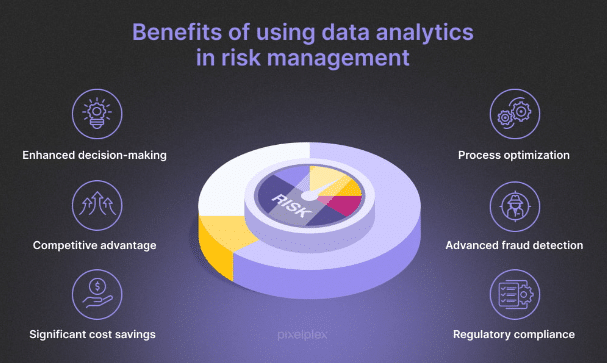

Here's why transparent reporting and analytics play a crucial role for merchant businesses:

Advanced Fraud Detection:

Without robust reporting and analytics tools, merchants are left vulnerable to the ever-evolving landscape of fraud and security threats. These tools act as a frontline defense, monitoring transactions for suspicious patterns and anomalies. Without this proactive monitoring, merchants may be unaware of fraudulent activities until too late, leading to financial losses, damaged reputations, and potential legal consequences.

- Transparent reporting and analytics provide high-risk merchants with real-time insights into transaction data, allowing merchants to identify and address potential risks promptly.

Prevention of Chargeback Risk:

Chargebacks are a huge headache for merchants, resulting in financial losses and operational disruptions. Reporting and analytics tools allow merchants to track and analyze chargeback data. Without such tools, merchants may struggle to find the root causes of chargebacks, preventing them from implementing effective prevention strategies. Unmanaged chargeback issues impact the bottom line and damage relationships with payment processors and acquiring banks.

- Some business types are categorized as high-risk, especially because of their high chargeback risk. Some examples are the travel and hospitality industry and businesses that depend on subscription models. Transparent reporting allows merchants to closely monitor chargeback ratios, find the root causes of disputes, and implement strategies to prevent chargebacks. By understanding the reasons behind chargebacks, merchants can address issues, improve customer service, and enhance overall customer satisfaction.

Data-Based Decision-Making:

Merchants must make informed, data-driven decisions to stay ahead in the competitive market. Without reporting and analytics tools, decision-making becomes guesswork. Merchants may miss growth opportunities, do not show areas for improvement, and make strategic errors that could have been avoided with proper data analysis. In a dynamic business environment, effective decision-making is crucial for long-term success.

- In-depth analytics empower high-risk merchants to make informed, data-driven decisions. Understanding customer behavior, market trends, and transaction patterns allows merchants to adapt their strategies to changing circumstances. Whether it’s adjusting pricing models, refining marketing strategies, or enhancing fraud prevention measures, transparent reporting provides the foundation for strategic decision-making.

Improved Customer Experience:

Customer experience is a key differentiator in today’s market. Merchants may struggle to understand customer behavior, preferences, and pain points without insights from reporting tools. This lack of understanding can lead to suboptimal customer service, pricing strategies, and product offerings. This can result in angry customers, reduced loyalty, and bad reviews, all affecting the brand’s reputation.

- Building customer trust is key, especially for high-risk merchants. These merchants often face criticism and moral judgment due to the nature of their industries. By providing clear and transparent reporting on transactions, security measures, and compliance efforts, merchants can show their commitment to transparency and build customer trust.

Non-Compliance and Legal Risks:

In industries with strict regulatory requirements, the absence of reporting and analytics tools increases the risk of non-compliance. These tools help merchants track adherence to industry regulations, ensuring that the business works within legal boundaries. Merchants may face fines, legal actions, and reputational damage without proper compliance management, particularly in high-risk industries such as finance, healthcare, or adult entertainment.

- High-risk industries are subjected to stringent regulatory scrutiny. Transparent reporting helps these merchants ensure compliance with industry regulations and standards. Detailed analytics help high-risk merchants track and adhere to compliance guidelines, reducing the risk of legal issues and penalties. This is particularly crucial in industries such as online gaming, adult entertainment, CBD, or pharmaceuticals, where compliance is closely watched.

Operational Optimization:

Reporting and analytics tools contribute to operational efficiency by finding bottlenecks, streamlining processes, and perfecting resource allocation. Without these tools, merchants may struggle with inefficient workflows, manual data processing, and a lack of visibility into critical business metrics. This can result in wasted resources, increased operating costs, and reduced competitiveness.

- Real-time data insights enable high-risk merchants to streamline their operations, find areas for improvement, and optimize business processes. This efficiency is crucial for managing high transaction volumes and ensuring that the business runs smoothly despite the inherent challenges of being in a high-risk industry.

Significant Cost Savings:

Accurate reporting and analytics are essential for financial planning and forecasting. Merchants need to clearly understand their financial performance, revenue streams, and potential challenges. Transparent reporting enables merchants to create realistic financial projections, allocate resources effectively, and make strategic decisions to drive long-term sustainability.

Competitive Advantage:

Businesses evolve, and market dynamics change. Reporting and analytics tools help merchants stay agile by identifying market trends, consumer preferences, and to find growth opportunities. Without these tools, merchants risk falling behind the competition, missing chances for expansion, and not capitalizing on emerging trends.

Conclusion

Online merchants face a lot of avoidable risk without reporting and analytics tools. Risks that have a serious impact on various aspects of their operations. From financial losses and security threats to poor customer experience and legal challenges, the absence of these critical tools leaves businesses exposed to a host of vulnerabilities in an increasingly complex and data-driven business landscape. By partnering with a payment service provider that includes reporting and analytics software in their value proposition, or which allows merchants to pull data into their reporting tools through API technology, merchants are protected against the risks mentioned in this article. This isn’t just a strategic choice, but it is a necessity for merchants aiming to thrive in today’s competitive markets. These tools not only help mitigate risks associated with fraud and chargebacks but also support compliance efforts, enhance operational efficiency, inform decision-making, build customer trust, and ease financial planning. As high-risk industries navigate complex landscapes, having a robust reporting and analytics system becomes an even stronger strategic asset for sustained success.

Want to learn more about transparent reporting?

For free advice, please contact our experts: at [email protected]

*******

This article was written by @SandeCopywriter on behalf of Segpay Europe.