- 5 minute read

Populated by 84.3 million people (twice the population of California), Germany is the fourth largest economy in the world after the US, China and Japan and the largest economy in Europe. It is the world’s third largest export nation. Germany is also home to half of Fortune’s Top 10 EU Corporations by revenue: Volkswagen, Mercedes Benz Group, Allianz Insurance, BMW Group and Deutsche Telekom.

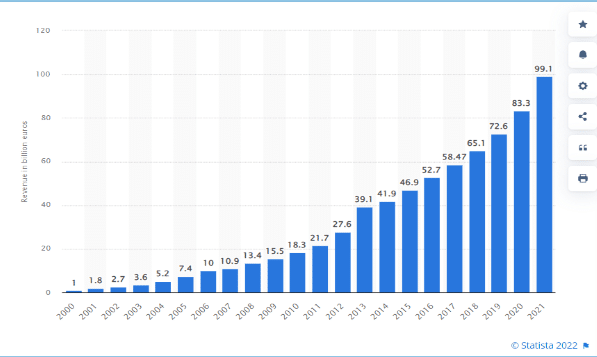

The European e-Commerce Market is expected to generate revenues exceeding the one-trillion-dollars-mark by 2027. In Germany, total e-commerce revenue grew with an impressive twenty billion euros between 2019 and 2021. In 2022, the total value of goods and services bought online passed the €100 billion threshold.

If we zoom in on Business-to-Consumer e-commerce, the German B2C market is expected to grow by 10.96% on an annual basis to US$58.4 billion in 2023.

Germany and Cross-Border eCommerce

In addition to eBay.de and Amazon.de, German retail market leaders Zalando, LIDL, Mediamarkt, IDEALO, and OTTO have made this country into an important European cross-border ecommerce hub. On average, one-fourth of the EU’s e-commerce revenue comes from cross-border sales. In 2021, cross-border ecommerce trade in Europe was worth €171.2 billion, 28.5% of which originated in Germany. In Austria, 80% of the country’s e-shoppers has bought products from foreign web shops and in the Netherlands, cross-border e-commerce spending has almost doubled, from €564 million in Q3 of 2020 to more than €900 million in Q1 of 2022. German e-shoppers like to buy from web shops in the Netherlands, Poland and Austria, which account for 61.9% of cross-border ecommerce into Germany.

This may come as a surprise, but Belgium is the EU’s cross-border ecommerce leader; almost one third of all ecommerce revenue consists of cross-border e-commerce. Interestingly, 30.3% of Belgium’s imported goods came from Germany, followed by China and the Netherlands.

Germany truly is the DACH (Germany, Austria, Switzerland) region’s giant.

Germany's Preferred Digital Payment Methods

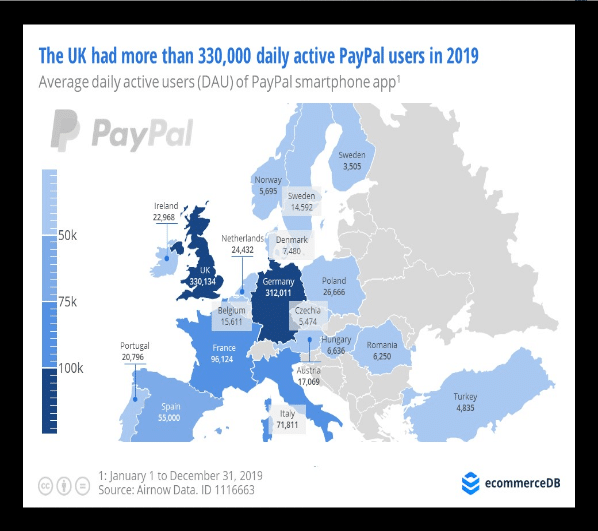

PayPal and e-Wallets (Apple Pay and Google Pay) are widely used in Germany, but merchants that want to expand into the German market should consider adding Giropay and Sofort (now part of KLARNA) to their check-out page. By offering these instant bank-to-bank payment methods to your German customers, you will be able to maximize your conversion rates in the region. Just like Dutch IDEAL, Giropay and Sofort are instant bank-to-bank payment methods and have been around for almost two decades. Both are available in over 30 countries. They are a popular payment in German-speaking DACH (Germany, Austria, Switzerland). Since the customer’s bank authenticates the transaction in real time, customer disputes, fraud and chargeback risk are minimized.

MasterCard and VISA are used to pay for online purchases, but do not account for more than one fifth of the market share. Elektronisches Lastschriftverfahren (ELV) is an electronic direct debit payment method, supported by banks that operate in Germany. It offers online shoppers a cheap, quick and easy alternative to card payments. The customer authorizes the merchant to charge the transaction electronically, by voicemail or by email through a web interface. Even though fraud risk is low, merchants are not well protected against chargebacks.

PayPal is extremely popular in Germany. In Europe, only the UK has more active PayPal users than Germany. Shoppers particularly love to use PayPal when they buy goods or services cross-border.

Open Banking and Fintech

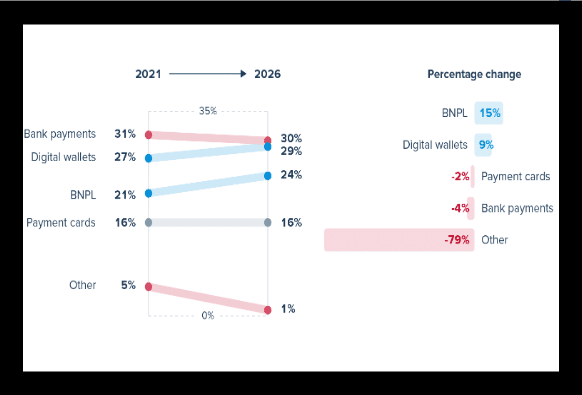

Open Banking has boosted Alternative Payment Methods (APM) in a country whose e-shoppers have never been great fans of card payments. Buy-Now-Pay-Later (BNPL) has grown popular amongst the younger generation German e-shoppers and is offered by Klarna and Afterpay (now Square), by PayPal (PayPal Credit) and by AmEx (SplitPay), Open Banking also improved the user friendliness of popular payment methods through API technology.

Despite the growth of e-commerce and online payments, Germans still have a strong preference for cash payments. According to a 2020 study by the European Central Bank, Germany has one of the highest cash usage rates in the Eurozone.

The German government has implemented strict regulations for e-commerce and online payments to protect consumers and their data and ensure fair competition. Apart from EU regulations such as the Payment Services Directive 2 (PSD2), payment service providers also must comply with the German Payment Services Supervision Act (ZAG). Besides the European General Data Protection Regulation (GDPR) German legislators also drafted the Federal Data Protection Act (BDSG).

German Fintechs are disrupting a Highly Competitive Landscape

In 2021, Deutsche Bank (DB) bought Better Payment Germany GmbH, a PSP based in Berlin. Through the acquisition, DB expanded its market share in payment processing and acceptance. In December, German-based mobile fuel station PSP PACE Telematics partnered with PayPal to facilitate mobile payments at gas stations. For the first time in Europe, customers were able to use their Apple Watch or Android smartphone to complete the transaction. This was just the beginning of exciting developments in a highly competitive fintech landscape.

In 2022, German BNPL B2B solution provider Mondu teamed up with US-based venture capital fund Valar Ventures, Cherry Ventures, FinTech Collective and senior executives from Klarna, Zalando, and SumUp and raised $57 million. In 2022, German fintech start-up SaveStrike launched a solution to help millennials to spend, save and invest in capital market, all in one app.

Last month, Raisin raised €60 million in a Series E funding round, its first fundraising after it landed €142 million in 2019. Through Open Banking, Raisin offers its clients competitive savings rates as well as through white-labelled integrations with third parties. Germany is also home to successful neo-bank N26, Mambu, BaaS providers Solaris Bank and Raisin Bank AG.

This month, Germany-based fintech Finanzguru has raised €13 million in a financing round, led by PayPal Ventures, with the participation of SCOR Ventures and the Deutsche Bank. In 2018, Finanzguru launched a multi-banking app that allows its customers to manage all of their banking accounts and contracts. With 1.5 million registered users, Finanzguru is Germany’s fastest growing fintech startup. It offers its customers independent advice on insurance and financial products including brokerage services, based on a digital analysis of their banking data, which can be accessed by phone or video chat.

Want to learn more about your recurring payment processing options?

Global payment facilitator Segpay helps merchants that want to expand their footprint into this exciting European market. In addition to payment processing solutions, Segpay allows you to offer your customers a variety of global, local and alternative payment methods. Segpay offers merchants Value-Added-Services, like subscription payment solutions, risk management and fraud detection, content monitoring and age verification through biometrics.

If you need free advice from one of our experts, do not hesitate to contact Segpay via: [email protected]

********

This article has been written by @SandeCopywriter on behalf of Segpay Europe.