- 5 minute read

Booming Economy Below Sea Level

With one-third of the nation below sea level, in a land twice the size of New Jersey, the Netherlands is home to 17 million people. This is one of the smallest and most densely populated countries in Europe, where high-tech innovation has always been a question of survival. From the famous Dutch windmills to modern-day Delta technology, only smart engineering and efficient water management have protected the Netherlands from being washed away by the North Sea. The Dutch developed unique solutions to guarantee water safety and sustainable economic developments in urban delta areas. This small country has one of the most sophisticated anti-flood systems in the world. The Dutch even built a 12th province – Flevoland – by turning the sea into land. This is why the Dutch have a saying: “God made the Earth in 6 days, and on the 7th day, when He rested, the Dutch made the Netherlands.”

Founders of Wall Street, the Dutch are historically known as traders. The Netherlands is the third largest exporter in the Euro Area. Agro-tech innovation has made this tiny country one of the world’s largest food exporters. The Netherlands has developed vertical farming, robotics, and innovative seed technology to boost production. The country is a major exporter of flowers, and the Dutch North Sea is rich in gas. Popularly known as Holland, the Netherlands is a popular tourist destination. In 2022, the country’s GDP was around 993.68 billion U.S. dollars

The Netherlands ; Major E-Commerce Hub

E-Commerce in the Netherlands is estimated at over $33 billion.

The most popular e-commerce marketplaces in terms of sales in the Netherlands include:

- Bol.com is one of the Netherlands’ largest and most popular e-commerce platforms. It offers a wide range of products. Bol.com serves as a marketplace for both retailers and individual sellers.

- Coolblue is a Dutch e-commerce platform specializing in consumer electronics and household appliances. It offers a wide selection of products, detailed product information, reviews, and excellent customer service.

- Marktplaats is a Dutch classified advertisement platform that works as a marketplace. It allows individuals to buy and sell various new and used items. Marktplaats is particularly popular for second-hand items.

- Amazon.nl: Amazon entered the Dutch market in 2020 with its localized platform, Amazon.nl.

- Wehkamp was the first online retailer and offers a wide range of products. It has a robust presence in the Dutch e-commerce market and provides flexible payment options, such as pay-later services.

Cross-Border E-Commerce

The Netherlands has a long history of global trade. This is reflected in a booming cross-border e-commerce market, as the Dutch love to shop and buy from foreign online merchants. This creates opportunities for businesses interested in a market with a truly diverse customer base. The Netherlands boasts a well-developed logistics and distribution network supported by modern transportation infrastructure and efficient supply chain management. This eases reliable and prompt delivery of online orders, which is crucial for a positive customer experience. The Netherlands is a multicultural society with a significant anglophone expat population. The Dutch government has implemented supportive policies to foster the growth of cross-border e-commerce.

Dutch shoppers are keen to buy products and services on foreign digital marketplaces, such as:

- Amazon’s international German, UK, and US marketplaces are popular choices for Dutch shoppers.

- Chinese online marketplace AliExpress offers a vast selection of products at competitive prices, often with free or low-cost international shipping options.

- eBay is a global online marketplace where people and businesses buy and sell various products.

- Zalando is a German fashion platform that operates in multiple countries, including the Netherlands.

- ASOS is a popular online fashion retailer based in the UK and offers a wide selection of trendy clothing, accessories, and beauty products.

- Wish is an e-commerce platform based in the United States known for its low-cost products, particularly in the electronics, fashion, and home goods categories.

- Etsy is a global marketplace focused on handmade crafts, vintage items, and artisanal products. Founded in 2005, Etsy is headquartered in Brooklyn, NY. It connects 7.9 million active sellers – 80% of whom are women – with 95.5 million active buyers in nearly every country in the world and has a significant presence in the Netherlands.

- Decathlon is a French sporting goods retailer with a strong online presence in the Netherlands.

- Banggood is a Chinese e-commerce platform that sells electronics, gadgets, clothing, and home goods.

The Dutch Digital Payments Landscape

For those merchants that want to expand their footprints across Europe, the Netherlands is an interesting market to start. Over 90% of the population speaks English, removing many language obstacles. However, one must be aware of the uniqueness of the Dutch e-payments landscape. Spoiler Alert: Card payments do not dominate the Dutch market.

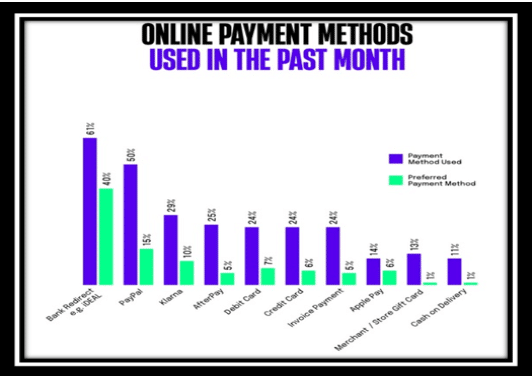

Preferred payment methods are:

- iDEAL allows consumers to make secure online payments directly from their bank accounts and is widely used for e-commerce transactions. Over 60% of respondents recently used iDEAL online, and 40% say it’s their first-choice payment method.

- Tikkie: Tikkie is a top-rated Dutch instant payment app that enables users to send payment requests via messaging platforms like WhatsApp or SMS. It simplifies splitting bills and payments between friends, colleagues, or merchants and customers.

- Electronic Payments: The Netherlands is one of the most cashless societies in the world. Electronic payments, such as debit cards and online transfers, are widely accepted and preferred over cash.

- PIN-based Payments: Personal Identification Number (PIN) payments are prevalent in the Netherlands. This system offers convenience, security, and speed.

- Contactless payments are widely accepted in stores, restaurants, and public transportation.

- BNPL (Buy-Now-Pay-Later) is popular in the Netherlands: 25% of Dutch respondents said they recently used Afterpay, while 29% reported using Klarna.

- Direct Debit: Direct Debit, known as “Incasso” in Dutch, is a widely used payment method for recurring bills, subscriptions, and other regular payments. It enables businesses and organizations to automatically collect funds from customers’ bank accounts with their authorization.

- Mobile Banking: The Netherlands has a high smartphone penetration rate, and mobile banking is widely adopted. Dutch banks offer feature-rich mobile banking apps allowing customers to check balances, make transfers, pay bills, and even start person-to-person payments using their mobile devices.

- SEPA: The Single Euro Payments Area (SEPA) has been implemented in the Netherlands, allowing seamless euro-denominated payments across European countries. This simplifies cross-border transactions within the Eurozone, making sending and receiving payments to and from other European countries easier.

Mobile Payments

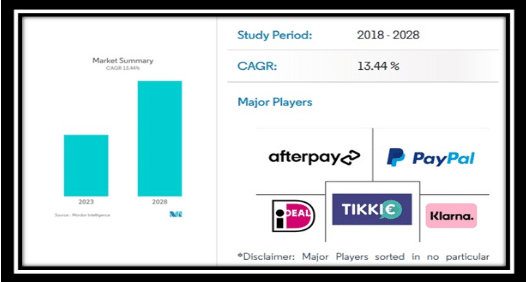

According to Mordor Intelligence, Dutch mobile payments market is expected to grow at a CAGR of 13.44% over the forecast period (2018 – 2028).

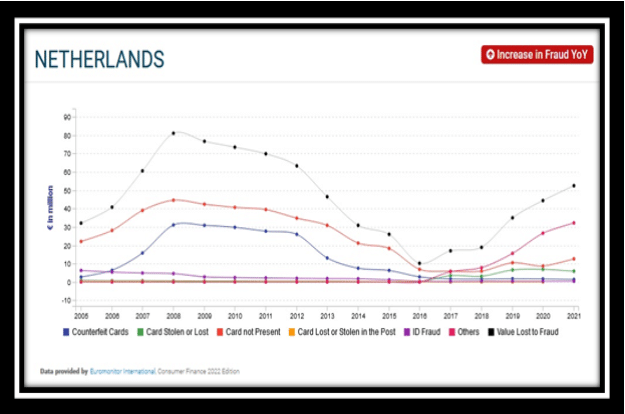

The Netherlands has one of the highest smartphone penetration rates in Europe. Dutch banks offer robust mobile banking apps, and mobile wallets are widely used. iDEAL covers about 70% of the market for online payments in e-commerce. In 2021, one-third of all transactions were made on a smartphone. The widespread adoption of electronic and contactless payments and unique payment methods like iDEAL and Tikkie contribute to a highly efficient and cashless payment ecosystem. Credit Cards are less popular in The Netherlands than in the rest of the world. This is why the Netherlands scores exceptionally low in CNP Fraud figures.

Low Card-not-Present Fraud

According to Insider Intelligence, card-not-present (CNP) fraud will account for $9.49 billion in loss, up 8.5% over last year. CNP will make up 73% of all card payment fraud losses this year, up from 57% in 2019. This is typically not the case in the Netherlands because of the Dutch’ strong preference for alternative payment methods.

However, fraud types such as account takeover or Social engineering fraud scams are rife across the region, and the Netherlands is no exception.

In conclusion, the Netherlands is a fascinating market for those merchants that want to operate in Europe. They must partner with a payment processor with knowledge and experience in the EU, where countries share one currency in one united SEPA region and under one EU PSD2 Payment Directive, but where there are huge differences in preferred payment methods.

Want to learn more about your recurring payment processing options?

If this article has raised your interest in the Dutch e-commerce market and its peculiar digital payments landscape, contact Segpay Europe, where our Sales Team can offer you the best free advice.

************

This blog has been written by @SandeCopywriter on behalf of Segpay Europe