- 5 minute read

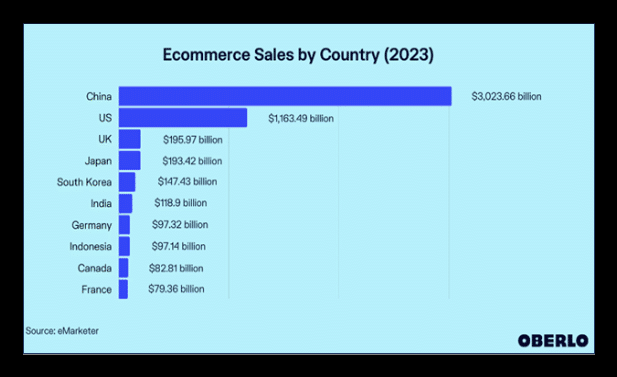

The United Kingdom is the world’s 4th largest e-commerce market, with a predicted revenue of $141 billion by 2023, placing it ahead of Germany. EcommerceDB expects a revenue with a compound annual growth rate (CAGR 2023-2027) of 7.8%, resulting in a projected market volume of $190 billion by 2027, while eMarketer is even more optimistic, predicting a market volume of $195.97 billion already by the end of this year. An exciting market that offers international merchants and cross-border payment processors partnerships to expand into European countries while leveraging the UK’s position as a major financial hub.

To capitalize on these opportunities, foreign payment processors should invest in market research, understand UK merchants’ unique needs and preferences, and adapt their services to align with local regulations and requirements. Building strong partnerships, fostering innovation, and offering exceptional customer service will be key to successfully penetrating and thriving in the post-Brexit UK market.

What are the Benefits of Partnering with a UK-based Global PSP?

Partnering with a UK-based global payment processor can offer numerous benefits for UK merchants. These benefits include:

- Regulatory Compliance: The Financial Conduct Authority (FCA) regulates a UK-licensed payment processor. Brexit led to the establishment of UK-specific data protection laws. International payment processors are known for their expertise in data security and compliance. By offering robust data protection measures, in compliance with strict UK regulations, and by providing secure payment processing solutions, UK-licensed global payment processors can position themselves as trusted partners for UK merchants.

- Local Expertise: A UK-based payment processor will better understand the local market, customer preferences, and regional payment trends. This knowledge can be valuable in tailoring payment solutions that resonate with UK customers.

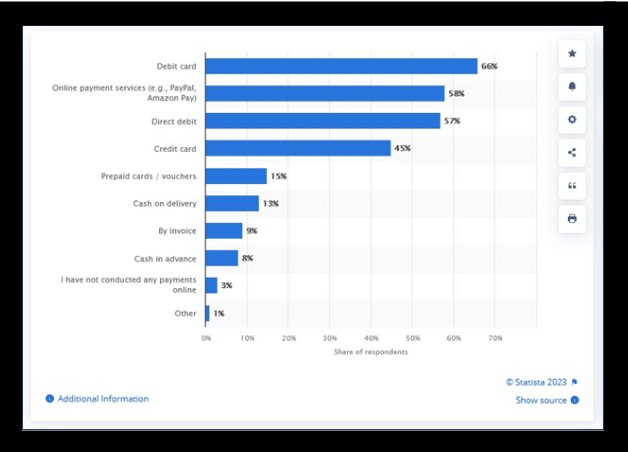

- Preferred Payment Methods: A UK-based payment processor is more likely to offer support for popular UK-specific payment methods, such as Faster Payments, BACS, Direct Debit, and others. Different regions have their preferred payment methods. A global payment processor typically supports a wide range of payment options, ensuring that customers from different countries can pay in their preferred way, reducing the chances of cart abandonment.

- Multi-Currency Support: Dealing with multiple currencies can be challenging for merchants, but global payment processors handle currency conversion, enabling merchants to price products in local currencies and receive a settlement in their preferred currency.

- Lower Transaction Costs: With a UK-licensed payment processor, merchants may enjoy lower interchange fees and transaction costs for domestic transactions compared to international payment processors.

- Excellent Customer Support: UK merchants partnering with a local payment processor can expect more accessible and responsive customer support during their business hours, eliminating potential time zone differences.

- Seamless Integration: A UK-licensed payment processor may have smoother integration with local banks and financial institutions, simplifying the setup process and allowing for quicker access to funds. Global payment processors can facilitate faster and more efficient settlement of funds, allowing merchants to access their earnings quickly, irrespective of the customer’s location.

- Expanded Customer Reach: Global payment processors can support transactions from customers around the world. By accepting payments in multiple currencies and from various regions, UK merchants can tap into international markets and attract a broader customer base through cross-border e-commerce.

- Cross-Border Payment Services: Brexit has created complexities in cross-border transactions between the UK and the EU. Global payment processors can leverage their expertise in international payments and offer specialized cross-border payment services to UK businesses. By providing seamless and efficient cross-border payment solutions, they can help UK merchants navigate the new regulatory landscape and mitigate the challenges associated with international trade post-Brexit.

- Increased Sales and Revenue: With access to a wider audience, UK merchants have the potential to increase their sales and revenue. Customers prefer the convenience of using their local payment methods, and a global payment processor can facilitate these transactions, leading to higher conversion rates.

- Enhanced Security and Fraud Protection: Reputable global payment processors employ advanced security measures to protect against fraud and ensure secure transactions. This helps build customer trust and safeguards the merchant and buyer from potential financial losses.

- Streamlined Checkout Experience: A global payment processor offers a seamless and user-friendly checkout experience. This reduces friction during the payment process and leads to higher customer satisfaction.

- Analytics and Reporting: Global payment processors provide comprehensive analytics and reporting tools. These insights can help merchants to analyze and understand customer behavior, sales trends, and other valuable data to make informed, long-term strategic decisions.

- Scalability: As businesses grow, they may want to expand their operations internationally. Partnering with a global payment processor ensures a scalable payment infrastructure that can handle increased transaction volumes without interruption.

By partnering with a global payment processor, UK merchants get access to advanced technologies, local and global payment methods, cross-border e-commerce, regulatory expertise, scalability, cost-effectiveness, and excellent customer support. These advantages can enable UK merchants to optimize their payment processes, expand their business horizons, and enhance their competitiveness in the evolving payment landscape.

What’s unique about the British Digital Payments Landscape?

- Fintech Hub and Innovation Ecosystem: The UK is a global hub for fintech innovation. London hosts a thriving ecosystem of fintech startups, established financial institutions, and venture capital investors. This environment supports the development of innovative payment technologies, such as mobile wallets, peer-to-peer payment solutions, and digital currency innovations. The concentration of fintech expertise and resources in the UK accelerates the pace of digital payment innovation and drives the growth of the sector.

- Well-Established Payment Infrastructure: The UK has a well-established payment infrastructure bolstered by the Faster Payments Service (FPS). The FPS enables near-instantaneous transfers between bank accounts, supporting faster and more efficient digital payments. The infrastructure also facilitates the seamless integration of payment solutions into various channels, including e-commerce websites, mobile apps, and point-of-sale systems, promoting the widespread acceptance and use of digital payments.

- Open Banking and API Integration: The UK has been a pioneer in open banking initiatives. Open Banking regulations require banks to provide secure access to customer data through APIs (Application Programming Interfaces). This has led to the emergence of innovative fintech solutions, including payment initiation services and account information services. Open Banking fosters competition, encourages product innovation, and provides consumers with greater control over their financial data, enhancing the digital payment landscape in the UK.

- High Adoption of Cards, PayPal, m-Payments, and e-Wallets: The UK has been at the forefront of mobile and contactless payment adoption. E-Wallets like Apple Pay, Amazon Pay, and Google Pay are widely used across the UK. This high adoption rate is supported by the widespread availability of contactless payment infrastructure in various sectors, including retail, transportation, and hospitality. The UK’s embrace of contactless payments has significantly influenced consumer behavior and shaped the digital payment landscape.

- Strong Regulatory Framework: The UK has a robust regulatory framework for digital payments. The Financial Conduct Authority (FCA) oversees payment services and promotes competition, innovation, and consumer protection in the payments sector. Additionally, the UK adheres to the Payment Services Directive (PSD2), which governs the provision of payment services within the European Economic Area. The regulatory environment fosters a secure and trustworthy digital payment ecosystem, promoting confidence among businesses and consumers.

- Strong Emphasis on Security and Fraud Prevention: The UK significantly emphasizes security and fraud prevention in digital payments. Strong customer authentication measures, such as two-factor authentication, are implemented to ensure secure transactions. Financial institutions and payment service providers employ advanced fraud detection and prevention technologies to safeguard against fraudulent activities. The focus on security helps build trust and confidence in digital payment methods among consumers and businesses.

This unique combination of well-established payment infrastructure, open banking initiatives, a strong regulatory framework, a thriving fintech ecosystem, and a focus on security collectively contribute to the distinctiveness of the UK digital payment landscape. These factors shape consumer behavior, drive innovation, and foster a dynamic and advanced payments ecosystem in the country.

Want to learn more about your recurring payment processing options?

If this article triggered your curiosity and made you wonder in which ways Segpay UK could help you to expand your business, do not hesitate to contact our payment experts via: [email protected]

**********

This article was written by @SandeCopywriter on behalf of Segpay International