- 5 minute read

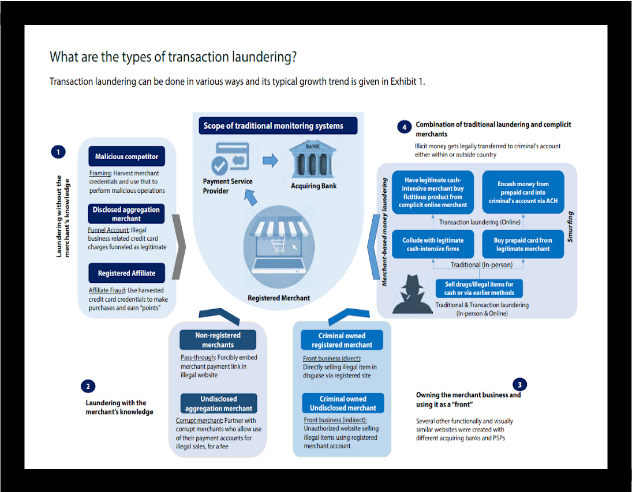

Transaction laundering is a deceptive and illicit financial activity in which a legitimate merchant’s payment processing system is exploited to disguise illegal transactions or the sale of prohibited or counterfeit goods and services. MasterCard defines transaction laundering as “the action whereby a merchant processes payment card transactions on behalf of another merchant.” Transaction laundering is also called factoring or transaction aggregation. Criminals abuse a legitimate merchant account to process illegal or fraudulent payments for illegal products or services.

Here's how transaction laundering typically works:

- Legitimate Front Business: A legitimate online business or merchant sells legal products or services (I.e., clothing, electronics, software) on a web shop or e-commerce platform. For example, a nutritional supplements seller launders drug money by inflating its receipts or sells counterfeit pharmaceuticals under the vitamin and supplement Merchant Category Code (MCC).

- Infiltration: Criminals gain access to the payment processing system of the legitimate business by hacking into the merchant’s system, using stolen credentials, or bribing fraudulent employees. Criminals embed a payment link on the legitimate company’s website and manually enter the illegal sales into the payment system to make the transaction more challenging to detect.

- Funnel accounts: Legal businesses that accept credit card charges from multiple companies that do not have their own merchant payment account because they are either too small or they engage in illicit transactions. The funnel company enters these payments as legitimate transactions into the card payment processing system.

- Money Laundering: The payments processed through the legitimate merchant’s system are used to launder money generated from illegal activities. Criminals try to launder their criminal money through the merchant’s accounts.

- Manipulation: Transaction launderers conceal the true nature of the transactions. They may manipulate transaction descriptions, disguise payment sources, and use multiple merchant accounts to make tracing illegal transactions more difficult.

- Profit Sharing: In some cases, the merchant agrees to be used as a mule to launder illegal money and receives a share in exchange for their silent collaboration. However, in most cases, the merchant is unaware of being abused by criminal gangs or transaction fraudsters and runs a tremendous risk.

- Hide & Seek: Transaction launderers know how to avoid detection by payment processors and regulatory authorities. They continuously change tactics and employ various methods to evade detection.

Transaction laundering poses significant risks and challenges for financial institutions, payment processors, regulators, and legitimate businesses. It can have severe legal and financial consequences for all parties involved. To combat transaction laundering, businesses and financial institutions must implement robust anti-money laundering (AML) and fraud prevention measures, regularly monitor transactions, and report suspicious activities to authorities.

Let’s have a look at some of the risks that merchants face if transaction launderers are abusing their online business:

Legal and Regulatory Consequences:

- Legal Liability: Merchants could be legally liable for facilitating illegal transactions through their accounts.

- Regulatory Fines: Violations of financial regulations and compliance standards can lead to heavy penalties.

- Loss of Licenses: Merchants may lose business licenses or face other regulatory sanctions.

Reputation Damage:

- Loss of Trust: Being associated with illegal activities or selling counterfeit products damages a merchant’s reputation among customers and partners.

- Reputation Damage: The merchant’s brand is damaged, which destroys customer trust and loyalty.

Financial Damage:

- Chargeback Risk: Transaction launderers often use stolen credit card information or engage in fraud, resulting in a high rate of chargebacks. Merchants risk heavy financial losses due to chargeback fees and the loss of goods or services.

- Termination: Payment processors may stop their relationship with the merchant if they detect transaction laundering, leaving them without a payment processing solution.

- Financial Loss: Transaction launderers may engage in unauthorized transactions, leaving merchants responsible for economic losses.

Legal Costs:

- Investigation and Legal Costs: Merchants must spend a lot on legal services and hire investigators to prove their innocence.

- Business Disruption: Legal and regulatory investigations can disrupt normal business operations and lead to financial losses.

Increased Scrutiny:

- Increased Scrutiny: After being implicated in transaction laundering, merchants may face increased scrutiny from financial institutions, regulators, and law enforcement agencies.

- Ongoing Compliance Requirements: Merchants may have to implement strict compliance measures and continuous monitoring to prevent future transaction laundering activities.

Criminal Charges:

- In extreme cases, merchants may face criminal charges if they are found to have knowingly participated in or facilitated transaction laundering activities.

Fraudsters constantly catch up with the latest technology by creating new money laundering schemes. Merchants must invest in training, costly high-tech solutions, and expensive experts. By partnering with a payment processor that offers risk management as a value-added service, merchants can focus on their core business: selling their products and/or services.

A payment processor that includes risk management, KYC/AML, and Customer Due Diligence services and robust fraud detection solutions in their value proposition helps merchants reduce costs and prevent the nightmare of accidentally becoming an aggregator for criminals.

In conclusion, detecting and preventing transaction laundering requires:

- Rigorous KYC procedures

- Transaction monitoring

- Tools to detect and report suspicious activities

- AI and machine learning solutions to detect suspicious patterns

- Knowledge to ensure compliance with AML and KYC regulations

- Ongoing Due Diligence, including regular reviews of merchant activities

- Maintain strict due diligence on third-party vendors

- Reporting and investigation process

- Education and training your risk professionals to help them detect complex transaction laundering schemes

Training, vigilance, technology, and understanding regulatory compliance are crucial to thwarting this illicit activity to protect your business from legal and reputational risks. Merchants must have effective compliance programs to prevent transaction laundering, protect their brand and reputation, and ensure regulatory compliance.

Want to learn more about how to protect your business from transaction laundering?

Contact us today, we’d love to chat with you about how Segpay can help you to protect your merchant business from transaction laundering. Reach out to us with your questions at [email protected]

**********

This article was written by @SandeCopywriter on behalf of Segpay Europe.