- 5 minute read

With a population close to 48 million and a GDP of $1,492 billion, Spain is the fourth most populated country in the EU after Germany, France, and Italy and the EU’s fourth economy. Tourism is an important source of income for the second most visited country in the world. Spain has 3000 miles of coastline and over 600 blue flag beaches. 83 million tourists visit this beautiful and versatile Mediterranean country annually, attracted by its vivid culture and famous culinary delights.

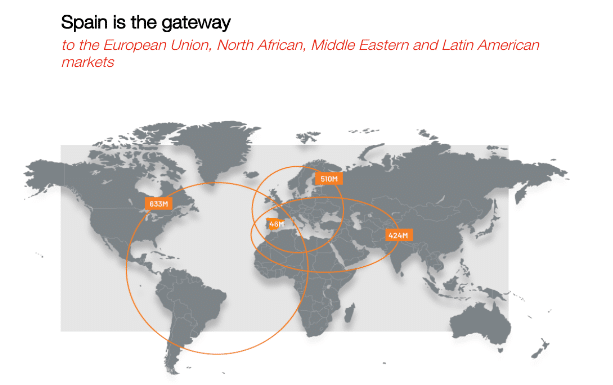

Due to its strategic location and colonial history, Spain has always been an important commercial gateway between Europe, LATAM, and MENA; three regions inhabited by over 1,5 billion people. With 470 million native speakers – 422 million of whom live in the Americas – Spanish is the world’s second most spoken language.

E-Commerce Growth

According to Statista, the Spanish eCommerce market is projected to reach US$37.62bn in revenue in 2023 at an annual growth rate (CAGR 2023-2027) of 10.63%, resulting in a projected market volume of US$56.36bn by 2027, when 40 million Spanish consumers will shop and buy products and services online.

Preferred Payments Methods; Cards, PayPal, e-Wallets, and Mobile Payments

Merchants that want to operate in Spain must understand Spain’s preferred payment methods. The country has been one of Europe’s pioneers regarding contactless payments. Payment cards issued in Spain are equipped with contactless technology, and consumers widely use this feature for quick and convenient payments. Spain quickly adopted mobile payment solutions offered by PayPal, Apple, Google, and Samsung. According to BNP Paribas’s 2022 report, 89% of users choose a card payment method to buy online, followed by PayPal (55%) as the second most popular digital payment method.

Bizum

In 2016, Spanish banks developed Bizum, a secure instant mobile payment solution. All you need is a smartphone and the PIN of a Bizum account, which is linked to your bank account. Shops and restaurants prefer to be paid through Bizum to avoid card transaction costs, and online merchants are adding Bizum as one of their mobile payment options. Bizum is immensely popular, and the number of banks that offer Bizum is growing.

Key factors that contribute to Bizum’s massive adoption:

- Wide availability: Bizum is supported by most major banks operating in Spain.

- Seamless integration with banking apps: Bizum is integrated directly into mobile banking apps, allowing users to send and receive payments within their familiar banking environment. This integration has made it convenient for users to access Bizum without needing separate apps or registrations.

- Peer-to-peer payments: Bizum is particularly popular for P2P payments among friends and family. It allows users to send money instantly using the recipient’s mobile phone number or WhatsApp without entering bank account details. This feature has made splitting bills, sharing expenses, and making quick transfers among individuals convenient.

- Security and trust: Bizum operates within the framework of the Spanish banking system, which provides a high level of security and trust for users. It uses the existing infrastructure and security measures of participating banks, ensuring that transactions are safe and reliable.

Fintechs and Popular Neo-banks

In Spain, international neo-banks are gaining popularity and are projected to grow by over 22% by 2026.

Besides market leader PayPal and global fintechs like Stripe, Revolut, N26, and (Transfer)Wise that are widely used in Spain, the country is home to a growing number of “home-grown” neo-banks:

- OpenBank was Spain’s first 100% digital bank, launched by Santander Group. It has users in Germany, the Netherlands, Portugal, and Argentina.

- Imagine is a customer-friendly Spanish neo-bank in partnership with Caixa Bank.

- Bnext: Bnext is Spain’s mobile-first neo-bank that gained popularity for its user-friendly app and innovative features.

- ID Finance is based in Spain and is available to citizens of both Spain and Mexico.

- Divilo focuses on freelancers and SMEs by offering secure payment and collections in addition to business models such as B2B, B2C, and B2B2C.

- Unibo specializes in B2B2C and has been created for real estate professionals and allows owners and renters to have a checking and transferring fund.

- RebellionPay is a Spanish neo-bank that offers mobile payments through a Spanish IBAN, MasterCard prepaid debit card, payments with Apple Pay or Google Pay, and instant transfers.

QR Codes are Widely Adopted in Spain

QR Codes have gained enormous popularity in Spain during the pandemic. Fortunately, the pandemic ended, but QRC is here to stay. QRC has become widely used across various sectors. Even in remote villages, restaurants and bars offer QR-coded menus. Customers view and order through their mobiles, after which the servers serve them food and drinks.

Shops offer mobile QRC payments, and Bizum has started to provide its users QRC as a payment option. QRC is also widely used in the Spanish transportation network as a ticket verification and payment method.

QR codes are also widely used for marketing and advertising purposes. Businesses use QR codes on promotional materials, posters, packaging, and advertisements to provide customers with additional information, discounts, or exclusive offers.

In Spain, QRC is widely used for ticketing and event management. They serve as digital tickets for concerts, sporting events, museums, and transportation services. Scanning QR codes securely validate tickets, controls access, and tracks attendance.

QR codes provide consumers with detailed product information, such as ingredients, origin, or manufacturing details, and help authenticate products against counterfeiting scams. Especially important in a country where many culinary specialties are DOP (Protected Designation of Origin) or IGP marked (Protected Geographical Indication).

Spain's Online Marketplaces

Besides global market leaders Amazon, eBay, Rakuten, and AliExpress, Spain’s most popular online marketplaces are:

- Milanuncios is a classified ads website widely used in Spain. It covers new and second-hand furniture, cars, scooters, and bikes, but the marketplace also includes real estate, jobs, and various offered services.

- El Corte Inglés: El Corte Inglés is a renowned Spanish department store. It offers various products, including fashion, electronics, home goods, beauty, and more.

- Fnac.es: Fnac is a popular French retailer specializing in electronics, books, music, and cultural products. Fnac.es is an online marketplace where users can buy products from various sellers.

- Conforama is a chain of stores specializing in selling furniture, appliances, home décor, and household items.

- TiendAnimal is an online store specializing in pet products.

- ManoMano is an online platform selling home decor, DIY, gardening, and construction products.

- Media Markt is a German chain of establishments that sells electronics products with a presence in more than 1,000 stores throughout Europe.

- French market leader Auchan Holding owns Decathlon, Leroy Merlin, and supermarket chain Al Campo. The other (online) supermarkets are Mercadona—with over one-quarter of Spain’s market share—Carrefour (7.6% share), and Germany’s Lidl (6.1 % market share).

- Wallapop is a prevalent platform where people buy and sell second-hand items. Its user-friendly interface enables users to browse, connect and communicate between buyers or sellers. The platform covers various categories, including electronics, furniture, clothing, vehicles, etc. Wallapop connects buyers and sellers based on their vicinity, which helps to reduce shipping costs.

The Spanish e-commerce landscape is expanding rapidly, and this article illustrates that Spain is a mature digital market with a lot to offer to merchants willing to expand their geographical footprint into Europe. Spain is an attractive cross-border e-commerce hub both for logistical and linguistic reasons. However, to benefit from such opportunities, partnering with a PSP that understands the Spanish market and offers a wide range of global and locally preferred payment methods is crucial.

Want to learn more about the different e-commerce markets?

The Spanish e-commerce landscape is expanding rapidly, and this article illustrates that Spain is a mature digital market with a lot to offer to merchants willing to expand their geographical footprint into Europe. Spain is an attractive cross-border e-commerce hub both for logistical and linguistic reasons. However, to benefit from such opportunities, partnering with a PSP that understands the Spanish market and offers a wide range of global and locally preferred payment methods is crucial.

Segpay is an international payment facilitator with a strong presence in the US, Europe, and Latin America. We offer merchants value-added services such as risk management, chargeback prevention, biometric age-verification tools, and dedicated customer services in both English and Spanish.

Feel free to contact our bilingual sales team for further information and free advice via; [email protected] and we can share more about the pros and cons of subscription model options.