Network tokenization is a technology used in the payment industry to enhance the security of digital and mobile payments. With the rise of e-commerce, mobile payments, and digital wallets, it is critical to maximize security to protect customers, merchants, payment service providers (PSPs), and banks from fraudsters, transaction launderers, and cybercriminals. Let’s explore how merchants and PSPs benefit from network tokenization and how this innovative technology revolutionizes the payment industry.

Here’s how it works and how it can benefit your merchant business:

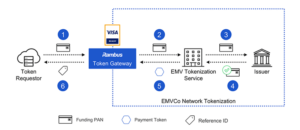

- Tokenization Process: When a customer adds their payment card to a digital wallet or makes a card-not-present (CNP) transaction (e.g., online or in-app purchase), the card details are replaced with a unique digital token.

- Unique Tokens: This token is specific to the device, merchant, or transaction, and it’s generated by the card network (e.g., Visa, Mastercard) or the digital wallet provider (e.g., Apple Pay, Google Pay).

- Secure Transmission: The token, rather than the actual card details, is transmitted during the transaction process, adding an extra layer of security. Even if intercepted, the token cannot be used for fraudulent transactions without the corresponding authentication mechanisms.

Suppose a customer purchases a refrigerator from an online store. During checkout, Michael enters his credit card information into the payment gateway. The gateway sends the card details to the tokenization system, which replaces Michael’s card number with a unique, randomly generated token, such as “j7w8fh42z1.”

The tokenized data returns to the payment gateway, which completes the transaction using the token. The merchant receives the token and stores it in their database rather than storing Michael’s actual card number. Three months later, Michael buys a PC from the same merchant, enters his details, and confirms the purchase. The token from the previous transaction is used to process the payment, and the merchant doesn’t need to ask for his card information again. The merchant can store the token instead of the payment details to reuse it for future transactions.

Network tokenization offers merchants a powerful tool to enhance payment security, reduce fraud risk, and provide a seamless and secure checkout experience for customers across various channels. Integrating tokenization into your payment processing infrastructure can help safeguard your business and build trust with your customers in an increasingly digital payment landscape.

Enhanced Security

Network tokenization offers a robust layer of security for card transactions, mainly through digital and mobile payment channels. Replacing sensitive card details with unique digital tokens significantly reduces the risk of data breaches and unauthorized access to card information. For merchants, this means greater peace of mind, knowing customer data is protected throughout the payment process. Similarly, PSPs can offer their clients a secure payment solution that helps mitigate the risk of fraud, chargebacks, and costly data breaches.

Reduced Fraud Risk

Fraudulent transactions significantly threaten merchants and PSPs, resulting in financial losses and reputational damage. Network tokenization helps combat fraud by making it more difficult for cybercriminals to intercept and misuse card information. Fraudulent activity is effectively prevented since tokens are specific to individual transactions or devices. This reduction in fraud risk translates to cost savings for merchants and PSPs, as it significantly reduces chargeback and fraud risk.

Liability Protection

- Legal and Financial Liability: Merchants and PSPs may face legal and financial liabilities in case of a data breach or security incident. Network tokenization offers a layer of protection by limiting the exposure of sensitive card data. Since tokens cannot be reverse-engineered to reveal the original card details, unauthorized access to customer information is significantly mitigated. As a result, merchants and PSPs can reduce their liability and safeguard their businesses against potential legal and regulatory consequences arising from data breaches.

- PCI Compliance. Tokenization also makes it easier and more cost-effective for businesses to comply with PCI DSS. Using tokenization, businesses can significantly reduce their PCI scope since sensitive payment data is not stored locally. According to a PCI Security Standards Council survey, companies that use tokenization can reduce the cost of PCI compliance by up to 85%.

Streamlined Checkout Experience

Providing a seamless and frictionless checkout experience drives sales and customer satisfaction. Network tokenization contributes to a streamlined checkout process by enabling customers to securely store their payment information in digital wallets or mobile payment apps. This means that returning customers can complete transactions with just a few clicks or taps without re-entering their card details for each purchase.

Studies have shown that merchants can experience authorization rates by using tokenization. Merchants benefit from higher conversion rates, and their customers benefit from a better shopping experience.

Secures Emerging Payment Methods

As the payments landscape continues to evolve, merchants and PSPs must adapt to support emerging payment methods and technologies. Whether it’s accepting payments through mobile wallets like Apple Pay and Google Pay or in e-commerce, tokenization enables merchants and PSPs to embrace new payment trends while keeping the highest standards of security and compliance. By implementing tokenization, businesses can securely store customer payment details, enabling quick and seamless one-click payments. Suppose your business model depends on recurring subscription payments. In that case, tokenization allows merchants to store tokens for each customer instead of their billing information, which adds a protection layer to a customer’s sensitive information.

For high-risk merchants who operate in industries with elevated levels of fraud and chargeback risk, network tokenization offers several key benefits that can help mitigate these challenges and enhance payment security.

Some of the benefits of network tokenization for high-risk merchants:

- Security – Network tokenization helps bolster security measures, offering greater protection against unauthorized access to customer data in high-risk industries, such as gaming, gambling, travel, adult entertainment, or businesses that depend on subscription models.

- Reduced Fraud Risk – Fraudulent transactions pose a significant threat to high-risk merchants, leading to financial losses and damage to reputation. Network tokenization helps mitigate fraud risk by making it harder for fraudsters to use stolen card information for unauthorized transactions. High-risk merchants minimize chargebacks, transaction laundering, and fraud risk.

- Improved Chargeback Management – Chargebacks are an excellent headache for high-risk merchants, often resulting in disputes over unauthorized or fraudulent transactions. Network tokenization provides merchants with evidence of legitimate transactions. Since tokens are unique, they serve as valuable proof of authorization in case of a chargeback dispute. This strengthens the merchant’s position and saves his finance and dispute department time and resources.

- Regulatory Compliance – High-risk merchants are subject to stringent regulatory requirements and compliance standards, particularly in gambling, gaming, adult, travel, or pharmaceutical industries. Network tokenization helps high-risk merchants meet regulatory obligations by enhancing data security and protecting customer privacy. By implementing tokenization technology, high-risk merchants are committed to safeguarding sensitive cardholder information, reducing the risk of regulatory issues.

- Customer Trust and Satisfaction – Building customer trust is even more critical for high-risk merchants, who often face scrutiny due to the nature of their business. Network tokenization contributes to customer trust and satisfaction by securing payment data in a secure transaction environment. When customers trust their data is protected, they are more likely to engage in transactions with high-risk merchants and develop long-term relationships. Ultimately, that trust leads to increased customer loyalty.

Conclusion

Network tokenization is a game-changer in the realm of payment security, offering both merchants and PSPs great benefits. By enhancing security, reducing fraud and chargeback risk, and improving the checkout experience, tokenization helps businesses protect their customers’ data and drive growth in a digital economy. As the adoption of digital payments continues to grow, network tokenization will play an integral role in shaping the future of payment processing, enabling merchants and PSPs to thrive in an ever-changing landscape.

Want to learn more about your recurring payment processing options?

Contact us today, we’d love to chat with you about annual vs monthly subscription payments and which is best for you. It’s another way we are here for our merchants All the Way to Paid ™. Reach out to us with your questions at [email protected] and we can share more about the pros and cons of subscription model options.

@SandeCopywriter wrote this article on behalf of Segpay Europe.