Vive la France!

- 5 minute read

With a population of 68 million, France is the world’s 7th largest economy measured by its nominal GDP ($2.92 trillion). It is the 5th largest trading nation in the world and the European Union’s second-largest economy.

We will see how language is a powerful cross-border e-commerce driver. Approximately 300 million people worldwide speak French as their first or second language. French is the fifth most spoken language in the world, after English, Mandarin Chinese, Hindi, and Spanish. It is an official language in parts of Canada, Belgium, and Switzerland, as well as in countries in West Africa, South America, and the Caribbean. French is also the official language of the United Nations, the EU, and the International Olympic Committee.

The French E-commerce Market

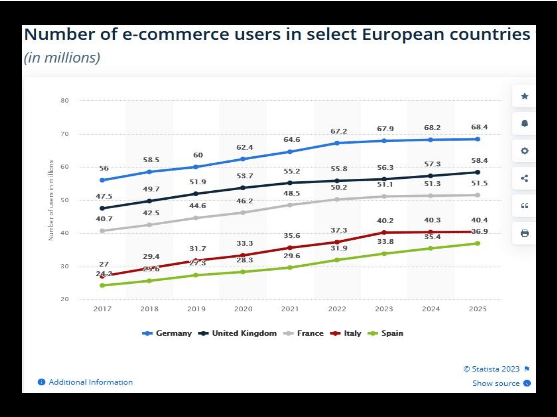

Ranking third after Germany and the United Kingdom, the number of French e-commerce users who shop and buy online passed the 50 million threshold. According to e-commerce Europe, the French e-commerce sector (products and services included) reached €146.9 billion in turnover for 2022, representing an increase of 13.8% compared to the previous year and a 33% growth compared to 2019. In 2022, 2.3 billion transactions were completed on Internet retail websites (products and services included), representing an increase of 6.5%. The French e-commerce market is expected to grow by 18.1% this year.

E-commerce Trends

- Mobile commerce is growing rapidly in France, with more than half of all e-commerce transactions now taking place on mobile devices. This trend is expected to continue as more consumers shop online using their smartphones and tablets.

- Social commerce is becoming increasingly popular in France, with many retailers using social media channels like Instagram and Facebook to sell their products directly to their target groups.

- Augmented reality (AR) is starting to be used in France. Some retailers use AR to help customers visualize products in their homes before making a purchase.

- Subscription-based, recurring payments are popular in France.

Examples of businesses that offer services that require secure, reliable, and customer-friendly subscription-based payment solutions to optimize retention rates are:

- SaaS business: France is home to many software-as-a-service (SaaS) companies, which rely on recurring subscription payments as a revenue model.

- Digital media companies: The digital media industry is growing rapidly in France, with many companies offering subscription-based services such as streaming video, music, and online news.

- E-learning platforms: With the rise of remote learning and online education, e-learning platforms have become increasingly popular in France. These platforms often rely on recurring subscription payments to monetize their content.

- Health and wellness businesses: The health and wellness industry is yet another promising market for a PSP specialized in subscription payments.

Cross-Border E-commerce

France is an important European e-commerce hub, and cross-border e-commerce represents a growing segment of France’s e-commerce market. In 2022, Statista estimated that half of France’s online shoppers already purchased cross-border, and 27% of French internet buyers ordered products or services from sellers located in countries within the European Union. According to a report by the French E-commerce Federation (FEVAD) published in 2021, French consumers’ top 5 favorite cross-border e-shopping countries were China, neighboring Germany, Spain, Italy, and the UK.

China is conquering the minds and wallets of cross-border e-shoppers worldwide, and France is no exception. The country offers a wide variety of products and very competitive pricing. China’s cross-border e-commerce will enjoy rapid development in 2022. According to data from the General Administration of Customs, the import and export volume of China’s cross-border e-commerce reached 2.11 trillion yuan ($294.67 billion) in 2022, up 9.8% yearly. Walmart sold its Chinese e-Commerce business Yihaodian to Chinese e-commerce giant JD.com in exchange for a 5.9% equity stake valued at $1.5 billion. JD’s cross-border e-commerce platform has attracted over 20,000 brands from the U.S., Canada, South Korea, Japan, Australia, New Zealand, France, and Germany.

French shoppers love to buy automotive parts, electronics, and home appliances from German webshops because of their solid and reliable reputation. MediaMarkt and Zalando are well-known e-commerce platforms in France. Zalando is a German-based online fashion and lifestyle retailer that operates across Europe. Zalando has a significant presence in France and is one of the most prominent e-commerce players in the fashion category.

According to a report by FEVAD, Zalando was France’s second most visited e-commerce site in 2021, with an average of 12.7 million unique visitors per month. Zalando has invested in localizing its services for French customers by providing French language support, payment methods, and a French version of its mobile app. Merchants know that language is key to attracting foreign customers

Neighboring Spain, Italy, and the United Kingdom are popular e-shopping destinations for fashion, home decoration, and beauty products. To share common borders is yet another tremendous cross-border e-commerce booster.

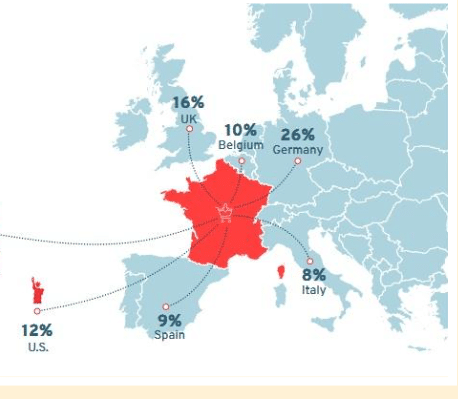

Cross-border E-commerce exported from France

Belgium, Germany, Italy, Spain, Switzerland, and the United Kingdom are home to a large French-speaking diaspora, and as such, they represent important European markets for French cross-border e-commerce export. French online retailers also sell cross-continental, mainly to the United States, Canada, China, and Australia.

Cross-border e-shoppers visit French web shops to buy:

- Fashion and Accessories: France is well-known for its fashion industry, and many online shoppers from abroad purchase clothing, shoes, and accessories such as bags, scarves, and jewelry from French retailers.

- Beauty and Cosmetics: French beauty and cosmetic products, including skincare, makeup, and fragrances, are highly regarded around the world.

- Gourmet Food and Wine: France is famous for its food and wine, and many online shoppers purchase French gourmet products such as cheese, chocolate, and wine to enjoy at home or to give as gifts.

- Home Decor and Design: French design and home decor are highly sought after, and many online shoppers purchase French-made furniture, textiles, and home accessories to add a touch of French style to their homes.

- Art and Antiques: France has a rich cultural heritage, and many online shoppers purchase French art and antiques, such as paintings, sculptures, and vintage furniture, from French retailers or online marketplaces.

We have seen how shared borders and a common language boosts cross-border e-commerce. Canada has the most prominent French diaspora in the world, with over 10 million people of French ancestry, particularly in the province of Quebec. The US is home to 2 million French expats, and millions of people in Belgium and Switzerland speak French. Approximately half a million French expats live and work in the UK, and Germany has a significant French-speaking population in the border regions of Alsace and Lorraine. Markets are full of cross-border business opportunities for merchants that sell French products or offer their customers a French-language webshop.

Successful French e-Marketplaces:

Besides global e-marketplaces such as Amazon and eBay, some of the largest French online marketplaces are:

- Auchan, better known as Carrefour, is France’s oldest e-commerce chain and is present in countries worldwide, including Luxembourg, Spain, Portugal, Poland, Romania, Hungary, Russia, Ukraine, Taiwan, Senegal, Mauritania, Tajikistan, and Tunisia.

- Cdiscount is a French e-commerce online marketplace that sells a wide range of products, including electronics, fashion, and home goods. Cdiscount, the largest French online retailer after Amazon, has a strong presence in the French e-commerce market.

- La Redoute is one of France’s oldest and largest e-marketplaces, and it has a loyal customer base.

- Vinted is a French online marketplace that specializes in secondhand clothing and accessories. It is popular among French consumers, particularly younger consumers who are interested in sustainable fashion.

- Fnac-Darty is an online marketplace and one of the largest electronics retailers in France

- Veepee is an e-commerce retailer that sells consumer goods like apparel, fashion accessories, toys, video games, wines, groceries, designer watches, phones, and more.

- Leroy Merlin is a French-headquartered home improvement and gardening retailer serving several countries in Europe, Asia, South America, and Africa.

- Decathlon SE is a French sporting goods retailer. With over 2080 stores in 56 countries and regions (2023), Decathlon is the largest sporting goods retailer in the world.

- e.Leclerc is an all-around online store that sells electronics & media, furniture & appliances, toys, hobby & DIY.

These French market leaders offer e-shoppers a wide range of products and services, and they represent a sizable portion of the French local and cross-border e-commerce market. In order to expand your merchant business into France, it is crucial to understand the French payments landscape.

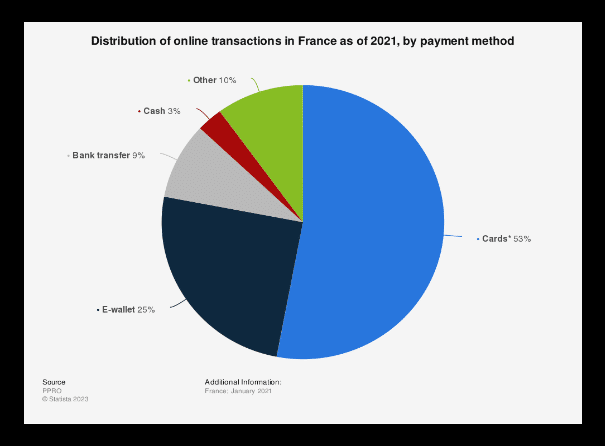

Preferred Payment Methods

France’s payments landscape is dominated by Cartes Bancaires (CB) and SEPA Direct Debit. CB is France’s national interbank network. Since 1992, all CB cards are smart cards; France was the first country to standardize smart cards with PIN verification, replacing magnetic swipe cards and signature verification. SEPA Direct Debit is a bank transfer system that enables consumers to authorize merchants to debit funds from their bank account. This payment method is popular in France for recurring subscription payments, such as rent and utility bills. It accounts for about 20% of all online transactions in the country.

Card Payments: Over 80% of French people own a CB card. More than 95% of these cards are co-branded with either Visa or Mastercard, meaning you can process these cards over Cartes Bancaires, Visa, or Mastercard networks.

PayPal: PayPal is a widely used payment method in France, particularly for online purchases. It allows users to link their bank or credit cards to their PayPal accounts. 41% of French e-shoppers use PayPal as a payment method for online purchases. French online merchants widely accept PayPal, and it is popular because of its user-friendliness, Buyer Protection program, and PayPal Credit, which allows users to pay for purchases over time.

Paylib: Paylib is a French mobile payment service that allows users to pay for goods and services using their smartphones. Many French banks support it, and it is becoming increasingly popular among French consumers.

Visa and Mastercard: Visa and Mastercard are widely accepted online payment methods in France. They are often used for cross-border transactions, as they are accepted in many countries.

Bank Transfers: Bank transfers are popular in France, particularly for larger transactions. Many French consumers prefer bank transfers for security reasons, as they do not need to share their credit card details online.

Digital Wallets: Apple Pay, Google Pay, Samsung Pay, and PayPal are popular amongst French Millenials and Generation Z, as they can pay with their mobile or smartwatch.

Lydia Pay: Lydia is a French local payment method (LPM) popular amongst the digitally savvy younger generations. It allows users to make peer-to-peer payments and pay for goods and services, contactless or online. Lydia is a mobile payment method that works with Apple Pay, Google Pay, Samsung Pay, and all other phones compatible with Lydia Pay. It is considered very secure, thanks to biometric identification. Lydia can be used for contactless payments thanks to its NFC Chip.

Merchants who aim to conquer French consumers’ hearts, minds, and wallets should partner with a payment services provider that understands the French e-commerce market, its shoppers’ payment preferences, and the country’s compliance rules and regulations.

Want to learn more about different e-commerce markets?

In this article, we explored the French e-commerce market. We zoomed in on cross-border e-commerce and highlighted the local payment landscape. If you are interested in expanding your merchant business into one of Europe’s fastest-growing markets and you are looking for an international payment processor with years of experience in providing merchants with secure, Value-Added-Services to expand their footprint into Europe, please do not hesitate to get in touch with Segpay’s international Sales Team via: [email protected]

***This article has been written by @SandeCopywriter on behalf of SEGPAY Europe.