- 6 minute read

Affiliate marketing is a performance-based marketing strategy in which merchants or advertisers reward individuals or other businesses (affiliates or publishers) for promoting their products or services to drive sales, leads, or website traffic. It’s a mutually beneficial arrangement where the merchant and the affiliate can earn money.

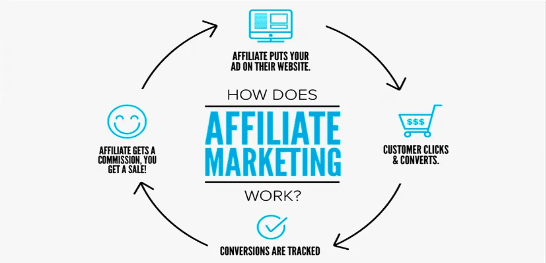

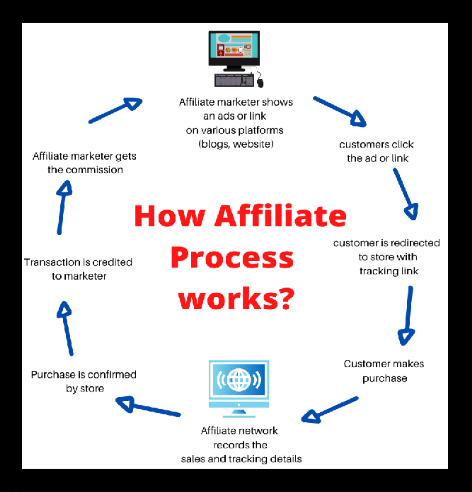

Here’s how affiliate marketing typically works:

- Merchant: The business or company that sells products or services and wants to increase its reach and sales through online marketing.

- Affiliate: An individual or entity (often a website owner, blogger, social media influencer, or content creator) that partners with the merchant to promote their products or services to their audience.

- Affiliate Program: The merchant sets up an affiliate program that provides affiliates with unique tracking links, banners, and marketing materials to promote their products or services.

- Promotion: The affiliate uses the provided materials and their marketing channels (website, blog, social media, email, etc.) to promote the merchant’s products or services to their audience.

- Tracking: Affiliate links contain tracking codes that monitor the affiliate’s referrals and track the actions taken by users who click on those links.

- Conversion: When a user referred to by an affiliate makes a purchase, fills out a lead form, or clicks on a specific link, it is counted as a conversion.

- Commission: The affiliate earns a commission or a predetermined percentage of the sale or auction each time one of their referrals results in a conversion. Commissions vary widely and are determined by the merchant’s affiliate program terms.

- Payment: The merchant regularly pays the affiliate their earned commissions, usually monthly.

Affiliate marketing offers several advantages for both merchants and affiliates:

- Cost-effective: Merchants pay commissions based on ‘no-cure, no-pay,’ a cost-effective marketing strategy.

- Broader Reach: Affiliates can help merchants reach new audiences and markets.

- Performance-Based: The performance-based nature of affiliate marketing means that both parties are motivated to maximize results.

- Scalable: Affiliate programs can be scaled up or down quickly to accommodate business growth or changes in marketing strategies.

- Minimal Risk: Merchants often have a low financial risk since they only pay for actual conversions.

- Diverse Marketing Channels: Affiliates can promote products or services through various channels, including websites, blogs, social media, email marketing, and more.

Affiliate marketing is a popular and effective way for businesses to expand their online presence and generate sales or leads while allowing individuals and entities to monetize their online influence and content.

What is the Role of a Payment Service Provider (PSP)

In affiliate marketing, PSPs play a crucial role as they process the financial transactions between the various parties involved in the affiliate marketing ecosystem. In addition to basic payment processing, a PSP with a deep understanding of all aspects of the affiliate marketing business can offer value-added services (VAS) to streamline, analyze, and secure a rather complex transaction flow.

Distribution of Commissions

PSPs calculate the commissions owed to affiliates based on predefined commission structures. These structures can vary, including flat fees, percentage-based commissions, tiered commissions, or a combination. Affiliates expect to receive their earnings in time. The PSP handles the distribution of commissions to affiliates based on the terms and schedule established by the affiliate program or merchant.

Track & Attribute

VAS may include affiliate tracking software, which helps to track and attribute sales or leads generated by affiliates. This tracking is essential to determine which affiliates drive specific conversions.

Currency Conversion and Preferred Payment Methods

Furthermore, the PSP handles currency conversions if the affiliate program operates cross-border. Affiliates want to receive their commissions in their local currency. A dedicated PSP offers various payment methods to accommodate affiliate preferences. These methods may include bank transfers, checks, PayPal, digital wallets, and more, depending on the options provided by the affiliate program or merchant.

Risk Management

Fraud detection and prevention measures are crucial in this type of high-risk business. A robust risk management system helps to protect both merchants and affiliates from fraudulent activities, such as click fraud or affiliate fraud.

Reporting and Analytics

A PSP specialized in affiliate marketing may offer reporting and analytics, providing merchants and affiliates with tools to gain a deeper insight into performance metrics, earnings, conversion rates, and other essential data. This helps affiliates to optimize their marketing efforts.

Customer Support

A PSP may offer added customer support to help merchants and affiliates with payment-related inquiries and issues.

A dedicated payment processor plays a significant role in the smooth operation of an affiliate marketing program. It ensures that affiliates are compensated accurately and on time, helping to maintain a positive and mutually beneficial relationship between affiliates and merchants. Additionally, payment processors contribute to the transparency and reliability of the affiliate marketing industry.

Why is this type of Business often considered High-Risk?

Affiliate marketing is often considered high-risk from a compliance perspective due to several factors that can increase the likelihood of regulatory and legal issues.

- Lack of Control: Affiliate marketing programs involve multiple affiliates who promote products or services on behalf of a merchant. These affiliates operate independently, and the merchant may have limited control over their marketing practices. This lack of control can lead to affiliates engaging in unethical or non-compliant marketing activities. The risk is exceptionally high when merchants refrain from subjecting their affiliates to solid due diligence (KYC screening) during the customer acceptance process.

- Potential for Misleading Advertising: Affiliates may employ aggressive or misleading advertising tactics to drive traffic and conversions. This can include false claims, deceptive advertising, or non-disclosure of affiliate relationships. Such practices can lead to legal and regulatory challenges, particularly if consumers are harmed or misled.

- Compliance with Consumer Protection Laws: Affiliate marketers must adhere to various consumer protection laws and regulations, such as the Federal Trade Commission (FTC) guidelines in the United States. These regulations require affiliates to disclose their relationships with merchants and provide clear and accurate information to consumers. Non-compliance can result in fines and legal action.

- Adherence to Privacy Regulations: Affiliates often collect and handle customer data, which can raise privacy concerns. Compliance with data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union, is essential. Mishandling personal data or failing to obtain proper consent can lead to significant penalties.

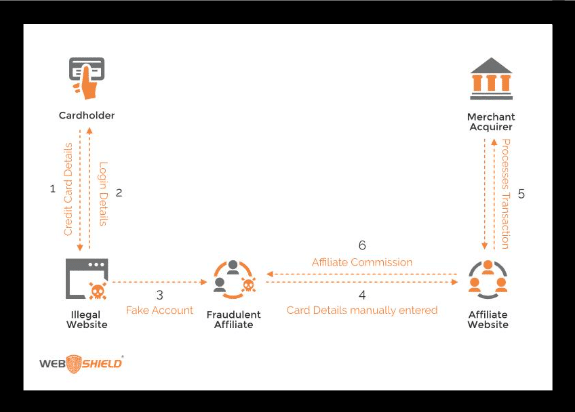

- Affiliate Fraud: The affiliate marketing industry is susceptible to fraud, including click fraud, lead fraud, and affiliate fraud. These fraudulent activities can harm merchants and consumers and result in legal actions and regulatory investigations.

- Transaction Laundering: Transaction launderers can abuse Affiliate Marketing to whitewash their illegally obtained wealth. This type of money laundering risk is explained in this video by Web Shield, a risk management and AML solutions provider that published a book on detecting and preventing risk, including a book about deceptive marketing schemes.

- Cross-Border Operations: Many affiliate marketing programs operate internationally, complicating compliance efforts. Adhering to the laws and regulations of multiple jurisdictions can be challenging and increase the risk of non-compliance.

- Rapid Changes in Online Marketing: Online marketing practices and technology are evolving rapidly. Staying compliant with changing regulations can be challenging for affiliates and merchants.

- Reputation Risks: Non-compliance can damage the reputation of both merchants and affiliates. Adverse publicity resulting from regulatory actions or legal disputes harms a brand’s image and could ultimately destroy a business.

To mitigate these compliance risks, merchants and affiliates involved in affiliate marketing should implement robust compliance programs. This may include clear affiliate agreements, regular monitoring of affiliate activities, education and training on relevant laws and regulations, and ongoing communication to ensure affiliates adhere to best practices. It is crucial to stay informed about legal changes and adapt marketing strategies accordingly to prevent non-compliance and fraud risk. One of the many benefits of partnering with a dedicated payment service provider is offering additional risk management solutions to mitigate risk.

The Added Value of Partnering with a Specialized PSP

A PSP specializing in processing medium and high-risk businesses can play a significant role in helping to secure affiliate marketing programs in compliance with rules and regulations.

- Expertise in High-Risk Industries: PSPs specialized in high-risk card processing have experience working with businesses in industries that are more prone to compliance challenges, such as affiliate marketing. They understand the unique compliance risks associated with this industry and can provide guidance and solutions tailored to address them.

- Enhanced Due Diligence: High-risk PSPs often conduct thorough due diligence on their clients and affiliates instead of leaving this up to the merchants. This involves reviewing business practices, compliance procedures, and risk management strategies to identify and address potential compliance issues before they become problems.

- Regulatory Knowledge: High-risk PSPs stay updated about the latest regulatory changes and compliance requirements that may impact affiliate marketing. They can provide insights into relevant laws and regulations, helping businesses stay compliant and avoid legal issues.

- Risk Mitigation Strategies: These PSPs can assist businesses in implementing risk mitigation strategies specifically designed for affiliate marketing programs. This may include monitoring affiliate activities for compliance, conducting audits, and implementing fraud detection and prevention measures.

- Transaction Monitoring: High-risk PSPs often have advanced transaction monitoring systems to help identify suspicious or fraudulent activities among affiliates. This helps ensure that affiliates are not engaging in non-compliant or fraudulent practices that could harm the business.

- Anti-Fraud Tools: Many high-risk PSPs offer anti-fraud tools and services that can help protect affiliate marketing programs from fraudulent activities. These tools can include fraud detection algorithms, chargeback prevention, and identity verification solutions.

- Compliance Documentation: PSPs can assist in generating and supporting the necessary compliance documentation, including affiliate agreements, terms and conditions, and privacy policies that align with relevant laws and regulations.

- Customer Support: High-risk PSPs typically offer dedicated customer support to address compliance-related inquiries and provide guidance on best practices for affiliate marketing compliance.

- Reporting and Analytics: These PSPs often provide reporting and analytics tools that help businesses monitor and assess their affiliate marketing program’s compliance performance. This includes tracking key metrics and identifying risk areas that may need attention.

- Dispute Resolution: In case of disputes or chargebacks related to affiliate activities, high-risk PSPs can help resolve issues and mitigate potential compliance risks.

By partnering with a specialized high-risk payment processor, merchants can prevent costly risk and compliance issues, but be aware that the ultimate responsibility for compliance rests with the business and its affiliates. By leveraging the expertise and services a high-risk PSP provides, affiliate marketing programs can enhance their compliance efforts, reduce regulatory risks, and operate more securely within a challenging industry landscape.

Do you want to know how international payment processor Segpay can help you to streamline and secure your business?

Contact us today, we’d love to chat with you. Reach out to us with your questions at [email protected]

*****

This article has been written by @SandeCopywriter on behalf of Segpay Europe