- 5 minute read

Merchants are reluctant to offer their customers the possibility to pay with cryptocurrency. Cryptocurrencies are subject to heavy fluctuations because the crypto market is extremely volatile. There are so many cryptocurrencies that merchants are not sure which ones are the most stable. Merchants need to pay their bills in FIAT. Therefore, they’d only risk adding crypto payments to their multi-currency payment offering if the PSP that they partner with can guarantee merchants a transfer in dollars, euros, pounds, etc. Then there are fears around compliance and risk management risk. The Financial Task Force (FATF) “Travel Rule” guidance requires that financial services firms, including VASPs, exchange personally identifiable information (PII) about customers sending and receiving funds over a certain amount in a bid to counter money laundering and terrorist financing. Coordinated with Financial Task Force (FATF) recommendations, the European Commission presented an ambitious package of legislative proposals in the EU’s Security Union Strategy for 2020-2025. The regulation of crypto assets exchange is included in this package and is defined in the proposed regulation of Markets in Crypto-Assets (MiCA). Rules and regulations imposed on cryptocurrency exchange differ per country, region, and jurisdiction. Neither merchants nor payment facilitators want to risk non-compliance. Besides compliance risk, merchants need to minimize chargeback and fraud risk. Merchants’ reluctance to offer their customers crypto payments is understandable.

The downside of the fear of accepting crypto payments is that merchants miss out on a lot of business. In Summer of 2021, there were over 81 million crypto wallet holders. Wallets with millions worth in cryptocurrency, with limited use to buy products and services online because only pioneering PSPs offer their merchants this payment option.

The latest PYMNTS Crypto Report revealed that an impressive 40% of 18–35-year-olds are planning to pay for goods and services with digital currency in 2022. That is up from around 30% in 2021. Close to 70% of the surveyed merchants say that the speed with which crypto payments are settled can potentially revolutionize their business models. More than 80% of merchants with existing crypto-payment options admit it was easier to settle using crypto than using fiat currencies.

Increase your revenue by accepting secure crypto payments

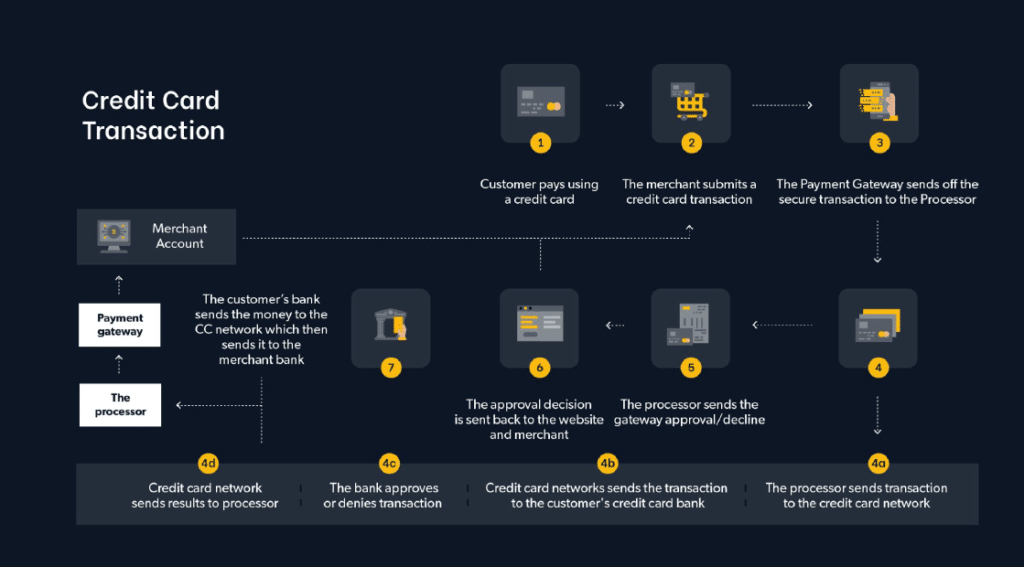

What, if merchants can switch to a payment service provider that allows them to tap into this market of digitally savvy millennials? There is a reliable processor out there with decades of experience in safe payment processing that can guarantee merchants that the customer’s crypto payment is authorized and settled in a currency according to the merchants’ preference. The wonderful thing about instant FIAT conversion is that it protects merchants from the volatility of crypto currencies. Cryptocurrency is processed instantly, allowing merchants to access these funds immediately. Instant transactions help streamline a business’s cash flow. Transaction fees for crypto payments tend to be significantly lower than the fees for card payments. With one simple API integration on both Android and iOS phones, the crypto option is added to the payment methods on the merchants’ web shop app.

Source: ForumPay

Now how about fraud and chargeback protection? The good news is that cryptocurrencies are based on blockchain technology, proven to be one of the safest technologies today.

Compliance and Risk Management

Merchants that do want to embrace crypto payments have to partner with a reliable payment facilitator that includes crypto currencies and advanced risk management in its value-added-services (VAS) . The available funds in the customer’s crypto wallet must be verified and the customer’s risk profile must be evaluated and assessed, all according to standard CDD KYC/AML procedures in compliance with the law. After the entire onboarding cycle, including customer identification, screening and ID verification, the customer’s crypto transactions undergo monitoring. Bad actors are filtered out and rejected through high-tech document-, image- and other ID verification. Your risk & compliance team does not have to be blockchain experts. A user-friendly crypto AML toolkit, a tool used by major banks, is used to ensure Enhanced Due Diligence. Customers are screened against 1000+ global watchlists and 100+ sanctions lists (I.e., OFAC, UN, HMT, EU, DFAT, etc.) and Politically Exposed People (PEP) lists. Cryptocurrency transactions are monitored and analyzed real-time on the blockchain; innovative KYC/AML compliance and risk management solutions that are used by major crypto exchanges, banks, and FIs.

Benefits

In conclusion, the benefits of partnering with a payment service provider that offers merchants the possibility to add crypto to its alternative payment methods outweigh the risks. Funds are transferred instantly and securely. Most importantly, how can there be chargeback fraud risk, when the blockchain saves a permanent record of the customer’s transaction without relying on a middleman? The customer simply authorizes the payment directly from the crypto wallet. According to a Mastercard study, chargeback disputes will cost the industry $409M by 2023. Crypto payments cannot be disputed when there isn’t any card organization involved. Once the crypto-wallet owner has been identified, screened, risk assessed as part of a KYC AML/CTF program, the customer is ready to pay with crypto for his/her online purchases. Therefore, it shouldn’t come as a surprise that PayPal already implemented a “Pay with Crypto” option that gives millions of US merchants the ability to accept crypto through PayPal’s PaaS. Segpay is ready to be a pioneer in the payment services industry.

Just to summarize the benefits of accepting crypto payments:

- Grow your Business

- Expand your geo-footprint

- Reach out to tech-savvy millennials

- Optimized Speed & Security

- Reduced Transaction fees

- Instant Access to Funds

- Chargeback Protection

If this article has raised your interest in how Segpay could help your business grow through the acceptance of crypto payments, don't hesitate to reach out to our Sales Team!

Contact us today. It’s another way we are here for our merchants All the Way to Paid ™. Reach out to us with your questions at [email protected] and we can share more about accepting crypto payments.

Author: @SandeCopywriter on behalf of Segpay International