- 5 minute read

The European Union’s Third Economy

Italy is the third-largest economy in the European Union (EU). The country is known for its high-quality machinery and equipment exports, luxury sports cars and motorcycles (I.e., Ferrari, Lamborghini, and Ducati), fashion brands, leather goods, and highly valued food and wine. Italy is also a significant exporter of chemicals and pharmaceuticals, and the country is known for its quality furniture, ceramics, glassware, and jewelry. Hence, La Bella Italia! Who doesn’t love Italy and the country’s outstanding contributions to the worlds of art, food, music, architecture, fashion, design, and cinema?

E-Commerce Growth, driven by Leisure, Tourism, and Online Marketplaces

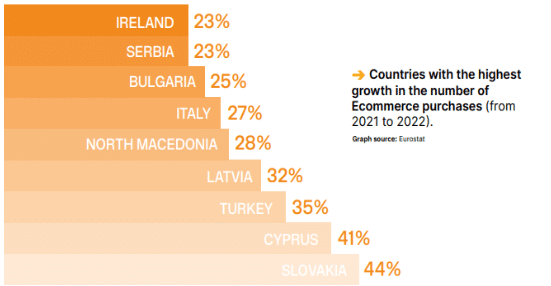

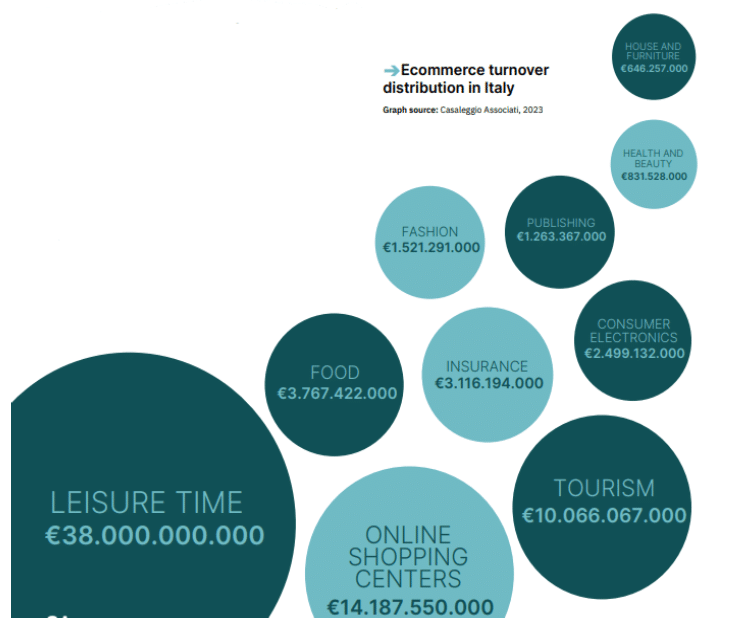

According to Italian market intelligence agency Casaleggio Associati’s most recent E-commerce in Italy 2023 report, Italy’s e-commerce turnover in 2022 is estimated at EUR 75.89 billion, with an annual growth of 18.58%. Italy is one of Europe’s fastest-growing e-commerce markets in terms of purchases.

Italians spend a lot on leisure (tickets, online gaming, content streaming, hobbies, and sports betting). Italy is one of the biggest sporting nations in Europe and hosts some of the biggest sporting events. Sports betting is a lucrative market.

Italians love to shop on local and foreign e-marketplaces (eBay, Amazon, Subito, Alibaba). European electronics, fashion, and sportswear retailers such as MediaMarkt, Zalando, and Decathlon attract a lot of Italian shoppers. Tourism is another powerful e-commerce driver. Casaleggio expects e-commerce to grow by 17.26% in 2023. The most considerable growth is expected in Leisure (+22%), Food and Fashion (+20%), and Health and Beauty (+19%).

Cross-Border E-Commerce

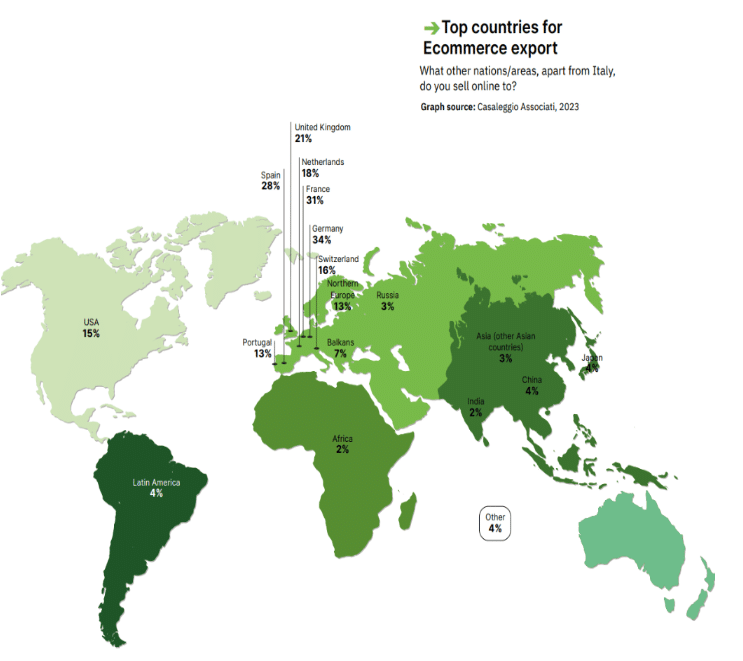

Italians love to visit and buy products and services on foreign web shops. Italians buy fashion, electronics, and furniture from Chinese, German, French, British, and American retailers.

Italian e-commerce merchants sell their products to customers abroad, in neighboring Germany, France, and Switzerland, but also to customers in Spain, the Netherlands, and the UK. Cross-border e-commerce in Italy is expected to grow in the coming years, presenting significant opportunities for international retailers looking to expand their footprint in the Italian market.

This presents exciting opportunities for PSPs that provide cross-border payment solutions in multiple currencies.

Italy’s Digital Payments Landscape: Cards, PayPal, and e-Wallets

Digital payment transactions recorded 397 billion euros, up by +18% compared to 2021. According to ECB data, Italy was one of the fastest-growing countries in 2022 regarding the number of transactions per capita (+33.6%).

During 2022, transactions via smartphones, e-wallets, and wearables amounted to 16.3 billion euros (+122% compared to 2021).

According to the Innovative Payments Observatory – an evolution of the historic Mobile Payment & Commerce Observatory – Italy’s most popular e-payment methods are:

- Credit and debit cards: Credit and debit cards are widely accepted in Italy and are the most common payment method for eCommerce transactions. Visa and Mastercard are the most popular card networks in Italy.

- PayPal is extremely popular in Italy, particularly for cross-border eCommerce transactions. The dominance of PayPal in Italy’s online shopping stands out. PayPal is the most common digital wallet in Italy, with a 91% market share.

- Digital wallets and wearables: Digital wallets, such as Apple Pay, Google Pay, PayPal, Skrill Pay, and Samsung Pay, are becoming increasingly trendy in Italy, particularly among younger consumers, and are used for around 38% of online purchases.

- Bank transfers: Bank transfers are also commonly used in Italy, particularly for larger purchases or when making payments to individuals or businesses that do not accept credit or debit cards.

- Buy-Now-Pay-Later (BNPL) is gaining attention in Italy, and according to Research and Markets, BNPL will record a CAGR of 26.8% by 2028. Time will tell.

Italians like to use local and alternative payment methods such as PayPal, Apple Pay, PostePay, Google Pay, Bonifico Bancario, and Bancomat Pay, Italy’s free, fast, and real-time mobile payment method. Biometric payment cards, wearable payment devices, and payments via payment links are all widely accepted.

Common local payment methods in Italy include:

- Postepay is a prepaid debit card that is issued by the Italian postal service. It can be used to make online purchases and is particularly popular among younger Italian consumers.

- Satispay is a mobile payment app that is becoming increasingly popular in Italy, particularly among small and medium-sized businesses. Satispay is popular for peer-to-peer payments. It allows users to transfer money to other users and to pay participating merchants.

- CartaSi is a popular online and offline credit card brand in Italy that is accepted by many Italian merchants.

- MyBank, Sofort, and SEPA Direct are popular bank transfer payment methods.

- Boleto Bancario is a popular payment method for sports betting. Many Italian e-commerce merchants that sell to Brazilian customers accept Boleto Bancario as a payment method.

Like most EU countries, the Italian payment landscape is diverse. Companies looking to target the Italian market should consider offering a range of payment options to cater to different consumer preferences. Merchants interested in conquering the Italian e-commerce market must partner with a payment processor with comprehensive knowledge of local payment preferences, including international and local payment methods, to cater to the importance of Italian consumers.

Business Opportunities

Italy’s e-commerce market is increasing and presents exciting business opportunities for international merchants and payment processors that offer mobile payment solutions that are popular in the EU, specifically amongst Italian e-shoppers. We have seen how Italian consumers have specific payment preferences, and there are several popular local payment methods that merchants may need to offer their customers to sell in the Italian market. Digital wallets are popular in Italy, particularly for e-commerce transactions. PSPs providing digital wallet solutions, such as PayPal or Google Pay, may be well-positioned to serve this market.

In addition to payment processing, there may be opportunities for PSPs to offer value-added services (VAS) to Italian merchants. VAS, such as compliance expertise in local and EU rules and regulations, integrated fraud prevention solutions, reporting analytics, or subscription payment methods.

Want to learn more about your recurring payment processing options?

Segpay is a payment service provider with an international presence in Europe, the US, and Latin America and dedicated sales teams to provide free advice and payment solutions tailored to your merchant business needs.

Feel free to contact us anytime at [email protected]

This article has been written by SandeCopywriter on behalf of Segpay Europe