If you’re operating an online business, it goes without saying that you need to accept credit and debit card payments. So, what is the best way to do it? You’ll need a company to process the payments, but which one you choose depends on how much internal control you want over the payments process versus how much you want to outsource to the processor. The more you want to outsource, the more you need to consider the services processors provide, and the fees they charge. In this article, we’ll discuss the most important factors to consider, so you can make an informed decision for your business.

Initial Setup

The first step toward accepting payments is to open a merchant account. You can do this on your own by shopping around for a bank that gives you the best deal.

Banks will evaluate your credit-worthiness as well as the nature of your business before granting you an account. If you are considered “high risk” – if there is a higher-than-normal level of fraud among businesses similar to yours – it might be difficult to obtain a merchant account on your own. Also, most banks charge setup fees – typically around $500 – to get your merchant account up and running. Many payment processors can obtain a merchant account for you, and most will do it without any setup fees. Processors typically have deep relationships with many banks and can leverage their reputation to get you a merchant account quickly and at no initial cost.

If you’re a relatively small business, the processor may pool you together with a number of other businesses under one account (called a Payment Facilitator arrangement). As your account grows and you have a good handle on chargebacks and fraud, you can be migrated to your own merchant account. The major credit card companies have rules that require the migration from Payment Facilitator to a direct account once you reach $1M in annual volume (MasterCard) or $100K in monthly volume (Visa).

Customer Support

The payment process doesn’t end when a transaction settles and funds are sent to your account. You need to provide support when customers have billing-related requests, such as refunds, account cancellations, updating card information, etc. If you have a support staff in place, great. You can opt for a processor that doesn’t provide – and charge for – those services.

However, many merchants don’t want to handle support on their own, let alone cover the costs of a dedicated team, which can run $2,500/month or more per support rep. For those merchants, there are many payment processors that provide support for your customer base via phone, email and/or online chat.

Often this includes customer retention programs aimed at keeping customers who may move to cancel their account, as well as rewarding longtime customers via loyalty programs, keeping them happy so they don’t make such a move. Typically the cost of customer support is covered in the transaction fees you pay the processor, and can save you in the long run versus running your own support team in-house.

Fraud Protection

Chargebacks are every merchant’s nightmare. They result in fees, and can cause your business to be deemed high risk by banks, potentially resulting in the freezing or cancelling of your merchant account. Chargebacks put your entire business at risk.

Combating fraud is perhaps the number one issue facing online merchants today. It is crucial to be able to identify fraudulent activity and prevent it before it results in chargebacks. And while you can’t completely eliminate fraud, there are steps you can take to minimize it and maintain as low a risk profile as possible. Hiring a dedicated fraud specialist can run $5,000 or more per month. Payment processors typically bring robust fraud detection and prevention tools, as well as the experience gained from monitoring payments over years.

Make sure your processor is compliant with PCI guidelines for protecting your customers’ billing data; and that they offer basic fraud management techniques such as a negative database, velocity limits, geo-location restrictions, AVS checks and 3-D Secure authentication. Similar to customer support, make sure your processor’s costs for risk management are covered in their transaction fees.

Alternative Payment Options

Accepting credit and debit cards will accommodate the vast majority of customers, however you could lose business if someone visits your site and can’t check out with the payment option of their choice, whether it is something like Apple Pay or a local payment option popular in certain regions of the world.

Offering multiple options may be less important if you deal with US customers only. Payment processors that operate globally typically have relationships with other 3rd parties to offer alternative payment options at no additional cost besides their standard transaction fees. Make sure the processors you are evaluating can accommodate the payment options your customer base requires, so you don’t miss out on business. At a minimum, they should support credit and debit card payments globally, along with direct debit in Europe.

If you operate globally, look for a processor that can present your customers with a checkout page in their local language as well as their local currency, as both are crucial for optimizing conversions.

Additional Services

Most payments processors provide other services to help your business. At a minimum, you should have access to reporting tools to view your transaction data and track your business’s performance. Reports such as sales summaries, chargeback/reversal stats, and projected revenues (based on scheduled recurring payments) should be standard. Other services could include user management so you can delegate billing tasks to fellow employees by assigning appropriate permissions. Some payments processors even help you grow your business by hosting their own affiliate programs to help you grow traffic through referrals. Programs such as these should come at no extra cost to you. They should be covered by the transactions fees you are already paying the processor.

Lastly, consider the type of support you are going to receive from the payment processor. Are you going to have easy access to a support team, or will you be stuck reading website FAQs while waiting for a response to your help ticket?

Fees

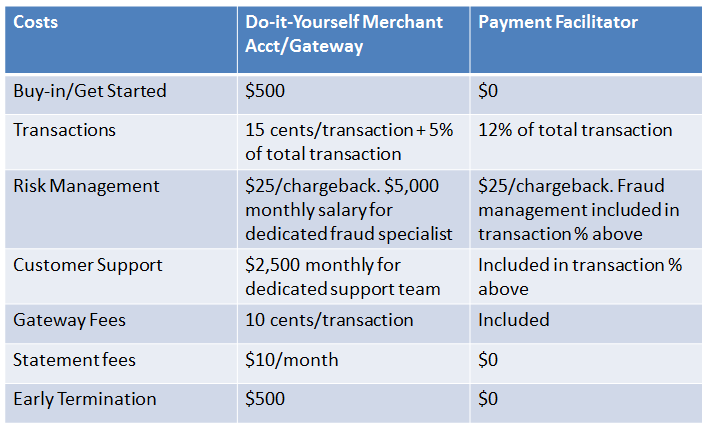

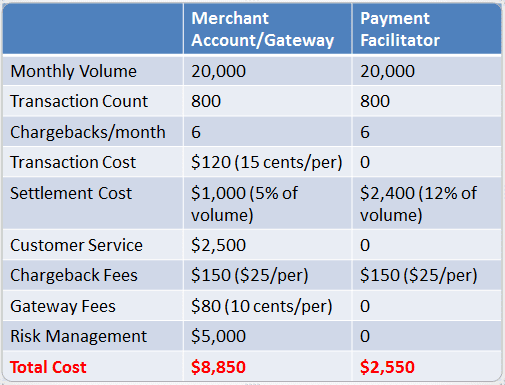

Fees will vary depending on the company you are working with, however we’ve put together charts to outline the typical fees in a traditional merchant account/gateway setup versus using a payments processor, as well as your estimated costs given a certain transaction volume. Of course, fees will vary, but this guide should help you evaluate processors to make sure your fees are covering the services you need, as discussed above:

Typical Fees

Estimated Monthly Costs

Now What?

Of course, not all of these factors will apply to your business, but it is important to be aware of them and know that payment processors can provide certain services so you don’t have to do it alone. This becomes especially important as your business scales and you need to focus on your business’s core strength and outsource in areas where it makes financial sense. Hopefully, the charts and overall discussion help you evaluate your own specific payment needs, and clarify what exactly you need to look for in a payments processor.